Quick facts

Minimum investment: EUR 25 000

Why your business should invest

its excess liquidity

Creating growth

Having a surplus in your business capital means you have more Having a surplus in your business capital means that you have more money available than is needed to cover ongoing operating costs and is simply because your business is doing well. There is an opportunity to invest and create growth in these.

Put the capital to work

It is important to put the capital to work, not just leave it in a low-interest account. Good returns on excess liquidity create greater opportunities in the future for survival, repayment to shareholders, and investment, for example. Many people's business capital savings problem is that inflation eats up the return from a low interest rate.

Inflation eats up interest returns

An inflation rate of, say, 2% means that every million kronor of capital decreases in value by SEK 20,000 per year. The interest on the savings account is generally eaten up by inflation, and there is no increase in value. Failure to invest surplus liquidity, therefore, has a longer-term impact. It is essential to have a buffer against unexpected expenses. However, keep the money in an account that gives you savings interest on the capital.

Optimize finances and increase profits

Capital that exceeds the buffer requirement is suitable for investment and yields a return. It will generate income outside the company's operations, and by making the best use of your surplus, you can optimise the economy and thus increase profits. The risk of the investment should not compromise the overall objective of preserving the purchasing power of the capital. In this respect, it is advisable to choose an investment that, first and foremost, can offer stability on the downside but simultaneously provide a good return in both the short and long term.

september 2024

Interest on interest is a powerful economic principle in long-term savings and investments.

Instead of withdrawing the generated return, you reinvest it so that your capital can grow organically over time. By doing this, the total amount of your savings increases, which in turn generates even more returns next time. Over time, the annual returns accumulate and begin to generate returns themselves, resulting in an exponential growth curve for your capital.

Amount invested

Savings horizon: 10 YR

Return cumulative:

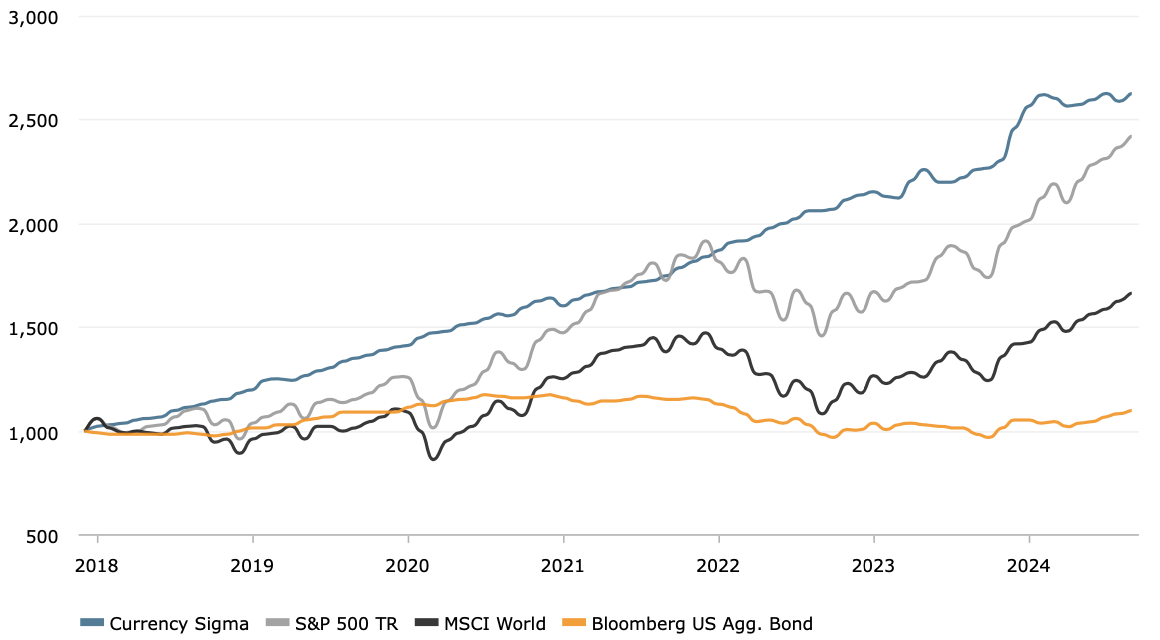

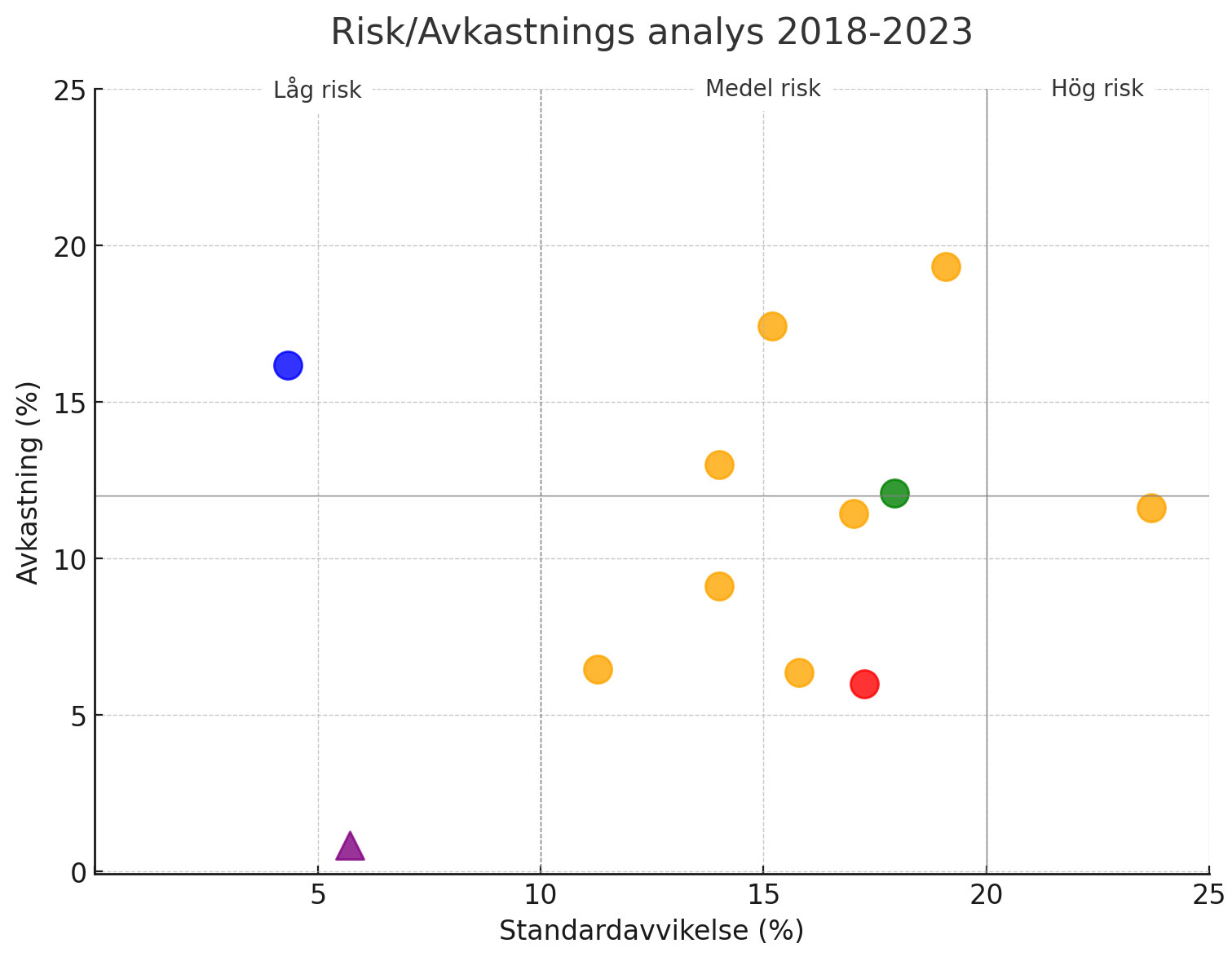

In the chart we see Currency Sigma

Along with bond indices, global equity indices and some funds that are known to perform well over time. We find Sigma in the upper left box with high returns at low risk and we can see that Sigma offers higher returns than global stock market indices at a lower risk than bonds.

Sigma is a good complement to e.g. equity funds in an investment portfolio.

HOW TO BECOME A CUSTOMER

01

Contact us at Chelton

02

We will help you get started

03

We start trading

Want to know more?

Enter your details and we will contact you as soon as possible.