Rising gold price

2024-04-30

BY CHELTON WEALTH

Gold is not an asset class because it does not generate cash flow, unlike, for instance, shares (dividends), bonds (coupons) or real estate (rental income). They are assets that produce something and generate a cash flow from it. These cash flows can be valued. This is not the case with gold; an ounce of gold remains an ounce of gold, even after many years. Gold belongs to the ‘what the fool gives for it’ category (the greater fool theory), just like many other scarce goods: crypto, French wine, Japanese whisky, classic cars, etc. What is the explanation for the rising gold price?

Gold is unique in that it is a Barbarian relic where, according to Warren Buffett, people go to great lengths to get it out of the ground only to put it away again deep underground (in a vault). Yet gold does have a unique role attributed to it that can add value to an investment portfolio. It can be seen as an investment in fear, as the ultimate safe haven negatively correlated with many financial assets. Incidentally, this negative correlation is not so bad. Gold prices are often under pressure when everything goes down the drain. Indeed, that is the consequence of any investment in an investment portfolio. After all, what good is a safe haven if you can’t tap into it in bad times?

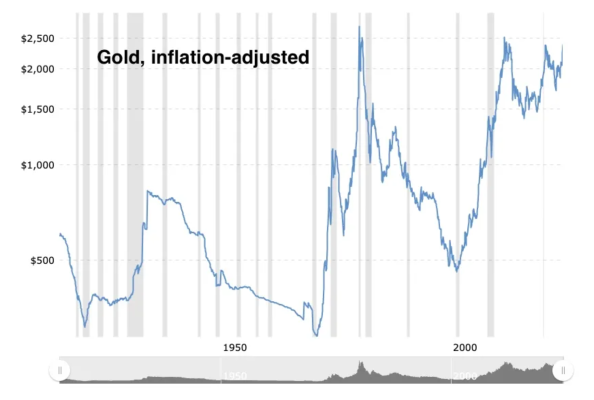

Gold versus Crypto Cryptocurrencies have largely taken over gold’s role (Gold 2.0). Normally, gold offers protection against sharply rising inflation. A rising gold price comes with negative real interest rates, but this was rather disappointing in the years following the Great Financial Crisis. Only now that real interest rates have turned positive again gold prices are remarkably rising. There are many advantages to cryptocurrencies over gold. Just try taking a bar of gold with you on holiday. This also makes cryptocurrencies popular in the grey and black markets. In practice, crypto is even more strongly correlated with financial markets. Bitcoin is effectively about three times the Nasdaq.

Gold complements an investment portfolio to the extent that it offers protection only in the event of extreme downside. Especially in times of war, gold has proven its worth in the past, but the advice then is to have gold that one can wear, for instance in the form of jewellery. Moreover, when buying a loaf of bread in hard times, it is debatable whether a gold bar is not exactly the most convenient medium of exchange. The advantage of gold that one can wear is that this can also be in the form of jewellery, so it also has a useful function in peacetime.

Central banks in Asia cause gold prices to rise Recent months have seen a surge in gold prices, largely driven by Asian central banks. These institutions, which previously accounted for 10% of global gold demand, have now doubled their share to 20%. The trend is particularly pronounced in emerging markets, including China, where central banks aim to hold 10–15% of their reserves in gold. Following Russia’s lead, this shift in strategy has significantly impacted the gold market, particularly at the expense of US dollar reserves.

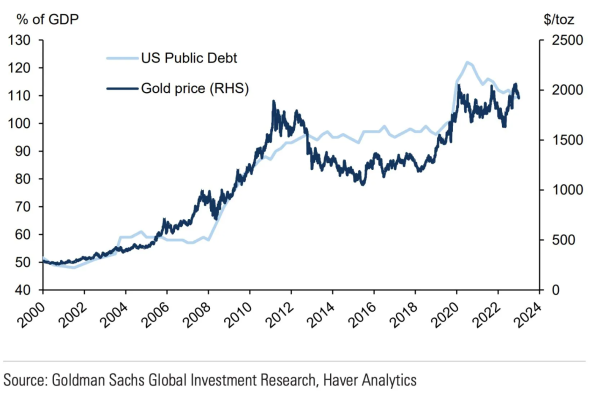

Now that the United States (along with allies) has used the dollar (and allies’ currencies) as a weapon against Russia, the Chinese think that something like this (for example, in the event of an invasion of Taiwan) could happen to them too. Gold is a better alternative as far as the Chinese are concerned. Moreover, China is all too keen on the renminbi as an alternative to the dollar. Therefore, the country tries to keep the currency stable against the gold price as much as possible. This also goes down well with business partners, including the Russians and Arabs.

Private individuals in China and Japan contribute to the rising gold price.

However, it is not governments in those countries that have pushed the gold price to a record but individual purchases. In the case of China, this is partly the result of the property crisis. Chinese had held about 80 per cent of their reserves in houses, but now that houses were there to live in and no longer to speculate with, they had to look for an alternative. Now, the Chinese are momentum investors, and the Chinese stock market is not attractive.

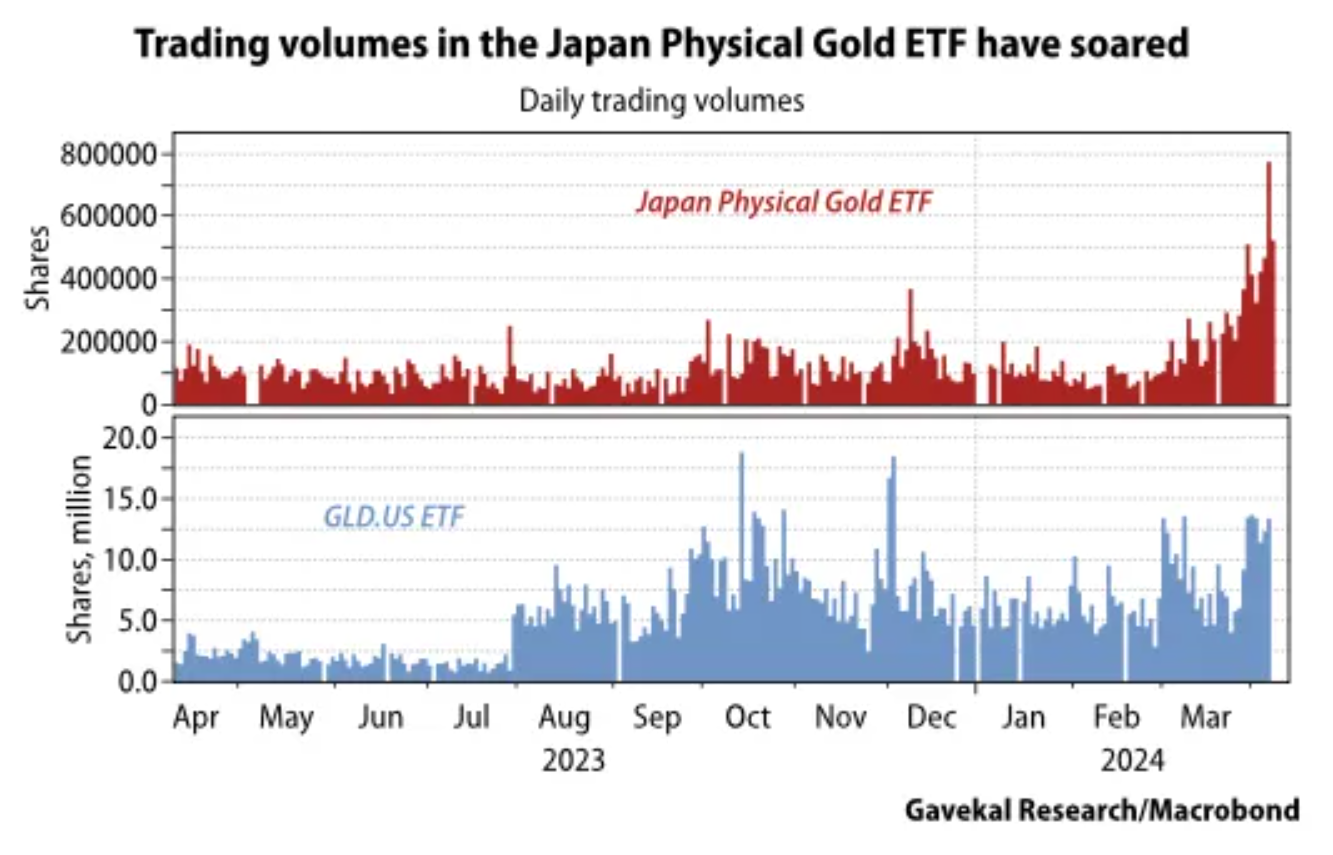

On the other hand, gold has traditionally had a role in holding reserves in many emerging countries (e.g., India and Southeast Asia). Another country where individuals are flocking to gold is Japan. That does not fit with the recent abolition of the Yield Curve Control (YCC) policy, but changes in Japan are very gradual. Instead of further tightening monetary policy, the Bank of Japan favours an extremely loose monetary policy. As a result, the yen came under further pressure. Gold is an alternative because carry trades are no longer interesting, and real yields are threatening to remain negative for many Japanese.

Stronger correlation between rising gold price and monetary policy

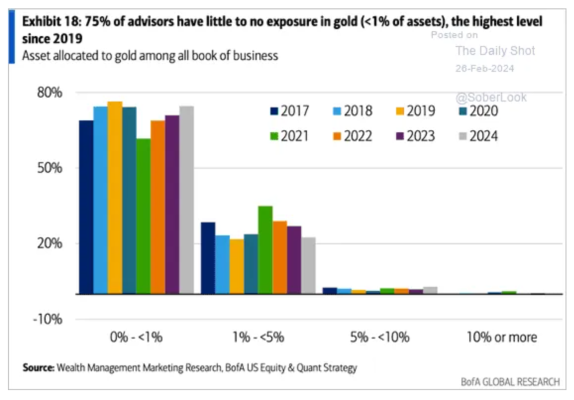

The weaker yen also caused China to weaken its currency a month ago. China is Japan’s most important export country and both countries compete with each other (e.g. in cars) in the global market, something that incidentally also affects Germany. This also caused Chinese individuals to seek and find a safe haven in the form of gold. More recently, this has been joined by individuals from developed countries, but they appear to prefer silver. This development also means that gold is no longer linked to real interest rates in the United States and Western Europe. The linkage of the gold price to the development of the US dollar is also much weaker than before.

Developments in Asia largely drive the rising gold price. As long as the Bank of Japan continues to advocate loose monetary policy, the Chinese government continues to allow its citizens to buy gold, the Chinese stock market does not suddenly become an attractive alternative to gold, and, of course, India’s economy continues to do well, momentum-driven Asian investors may push the gold price further higher.

Gold mines do benefit from this time Higher gold prices are good news for gold mine shares for once. In the past, many gold mines sold the gold they had yet to mine ahead of time. With rising gold prices, the cost of mining gold often rose as well. Ironically, this meant that a rising gold price could cause gold mines to take big losses. This is similar to the trend in construction. When construction picks up sharply and, therefore, costs also rise sharply, many builders suddenly run at a loss.

Post-Corona, mining costs are now falling, after a sharp rise in 2020 and the inflation that followed. With that inflation also coming off, gold prices are suddenly risingwhile they have stopped mainly selling gold forward. Especially in coronavirus times (when they could not deliver), this proved to be a dangerous exercise. The result is a sharp improvement in profit margins. Moreover, mining companies are benefiting from an improving global economy, especially if the construction situation in China and the United States also starts to improve and there is more investment in the energy transition which is effectively a metals transition.