US dept ceiling

2023-11-09

BY CHELTON WEALTH

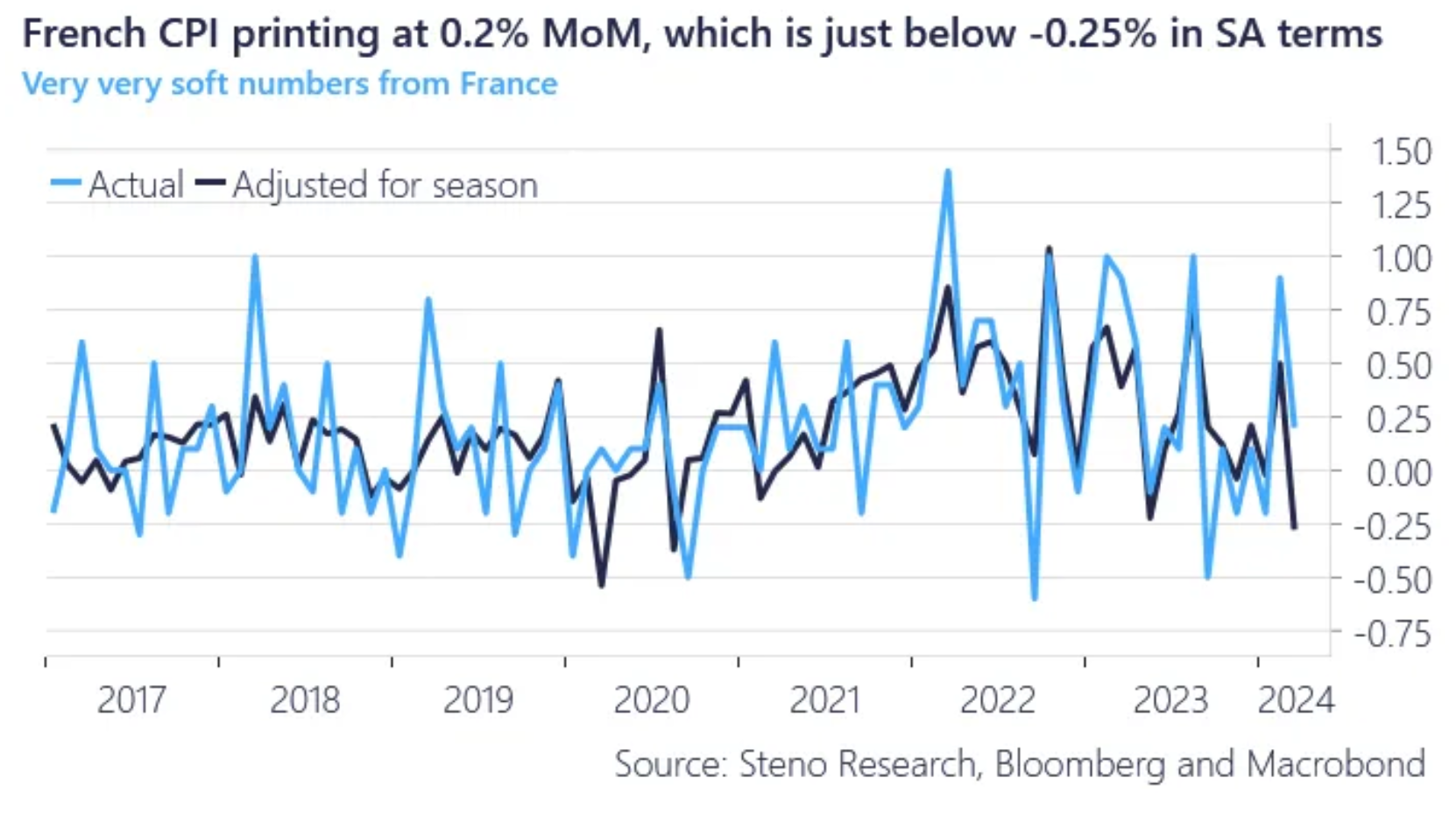

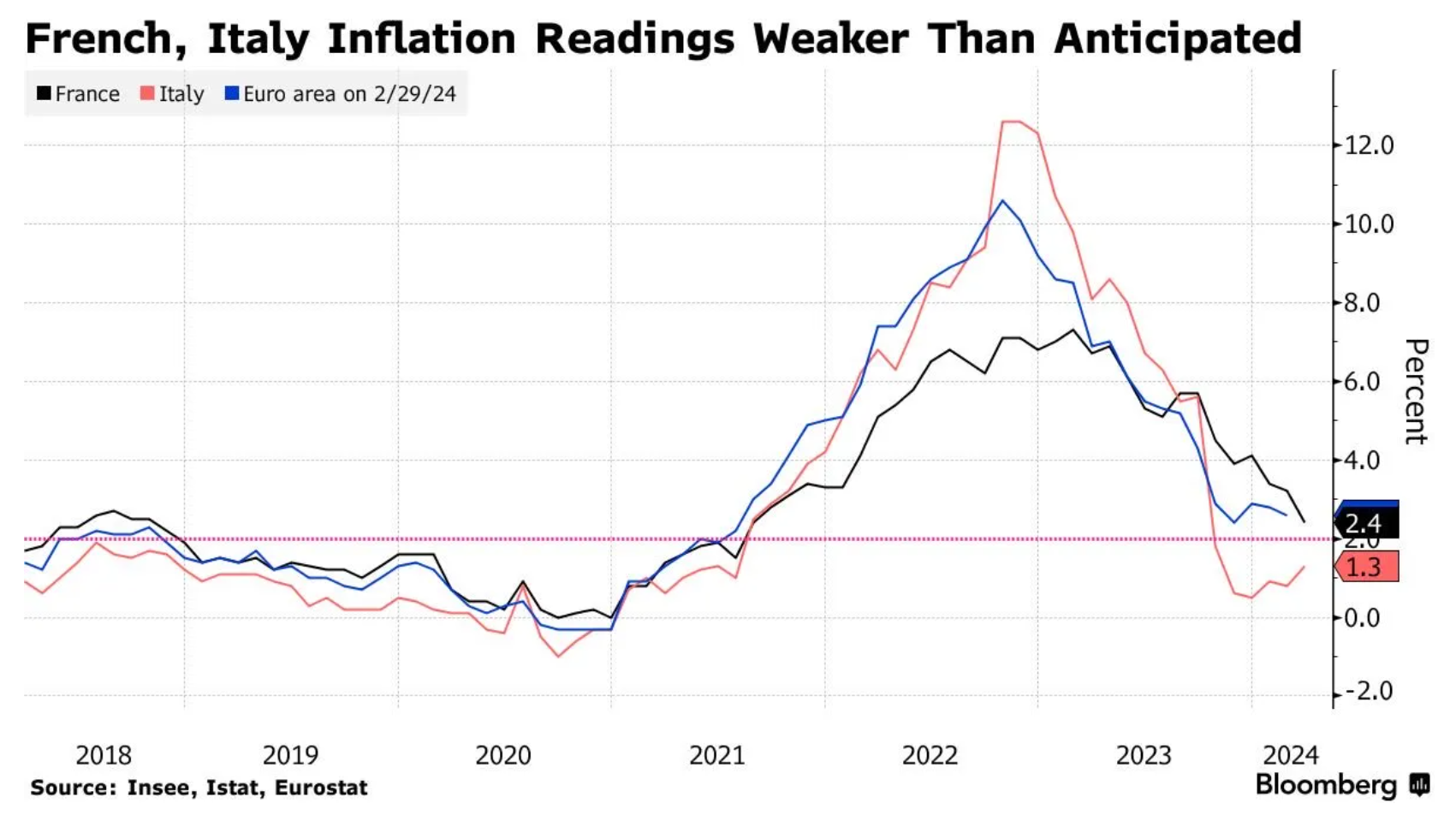

French inflation fell faster than expected to its lowest level since July 2021, while inflation also fell short of expectations in Italy. This has made it likely that the ECB will cut interest rates soon. According to figures published by the national statistics office, consumer price growth in France slowed to 2.3 per cent in March from 3.2 per cent in February. The market had expected 2.8 per cent

Surprisingly sharp fall in inflation in France

The drop in France reflected disinflation in all areas, including a fall in services inflation to 3 per cent, a drop in energy inflation to 3.4 per cent and a sharp fall in food inflation to 1.7 per cent. Fresh food prices fell 3.9 per cent in the year to March. Monthly, inflation in the eurozone’s second-largest economy slowed to 0.3 per cent from 0.9 per cent. The figures, which anticipate next week’s figures that are expected to show that eurozone inflation slowed slightly to 2.5 per cent, are likely to convince investors that the ECB will start cutting interest rates by June at the latest. There is even renewed speculation about an April rate cut.

Italian and Spanish figures also turned out better than expected.

In Italy, inflation rose 1.3 per cent in the year to March, a smaller-than-expected increase from 0.8 per cent in the previous month. Italy’s statistics office said the rise was due to the end of seasonal clothing sales, higher transport service prices and a slower fall in energy costs. The market had expected 1.5 per cent. Spanish figures published on Wednesday showed that inflation in the eurozone’s fourth-largest economy rose slightly less than widely expected, from 2.9% in February to 3.2% in March. Spain’s core inflation slowed to 3.3 per cent in March from 3.5 per cent in February.

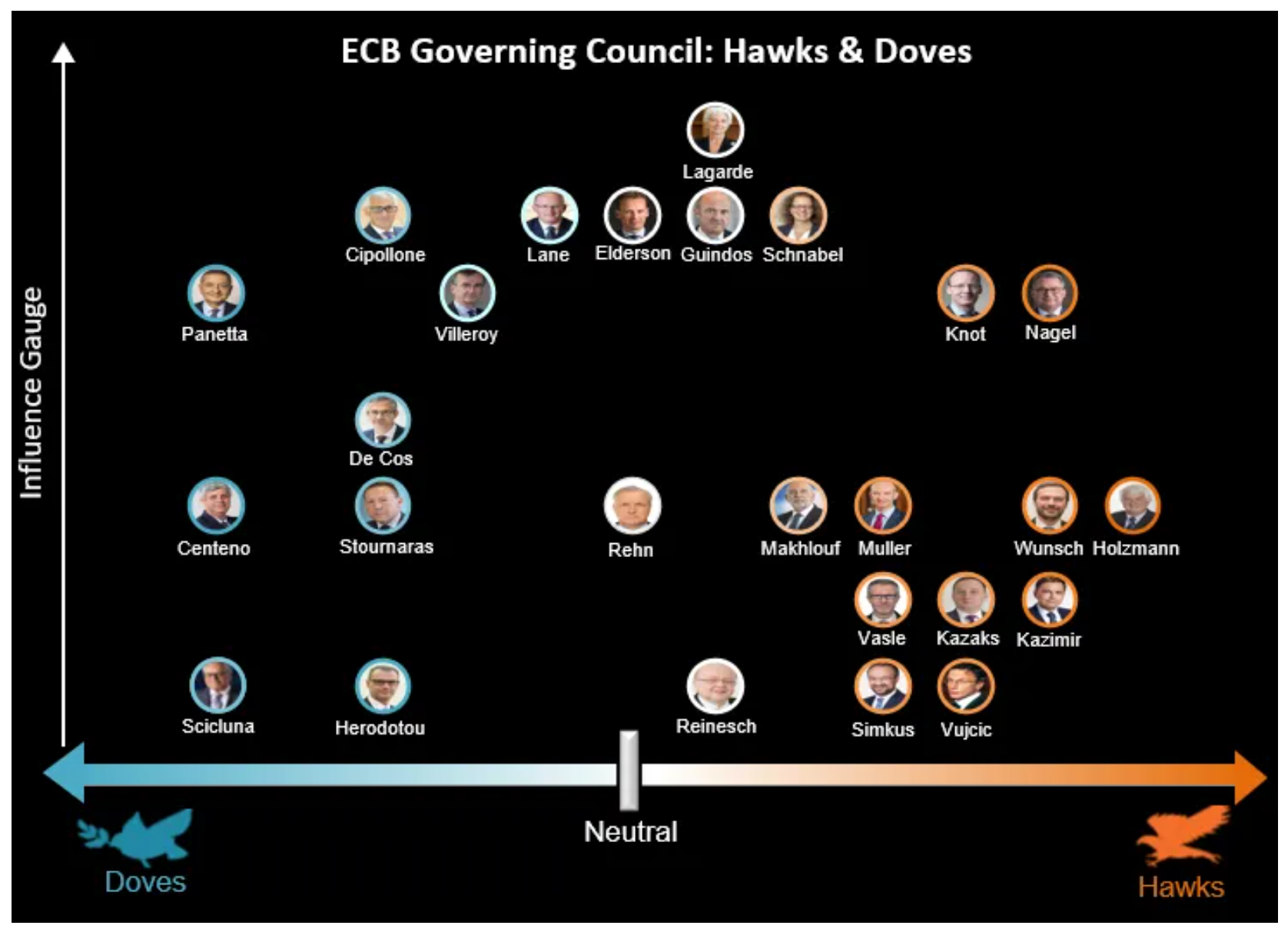

Possible four interest rate cuts in 2024

Yannis Stournaras, governor of Greece’s central banks and member of the ECB, is now even counting on four interest rate cuts by the ECB in 2024. If inflation continues to develop as it did in March, that should be possible. That means the ECB would have to cut interest rates twice before the summer. For now, Stournaras stands alone in his view, but the inflation figures support his argument. Moreover, Stournaras argues that the differences in opinions on when to cut interest rates are much less than suggested by the market.