Inflation this year

2025-02-21

BY CHELTON WEALTH

Inflation this year

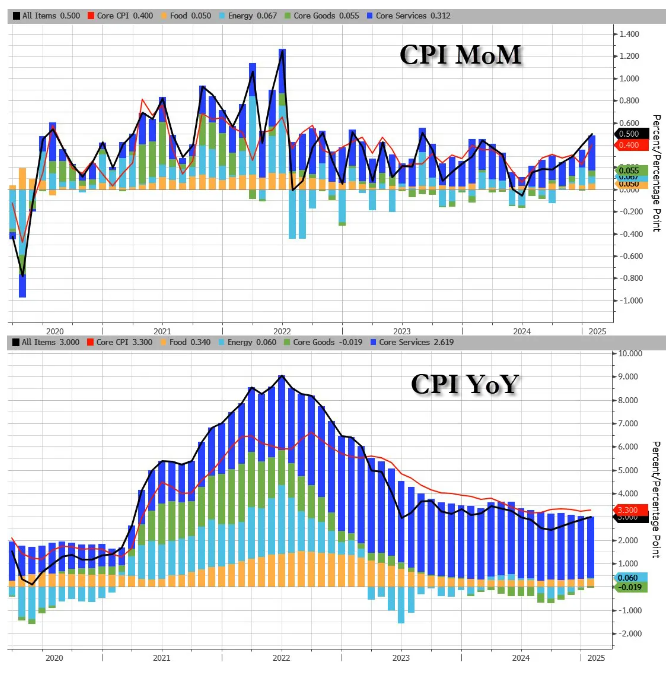

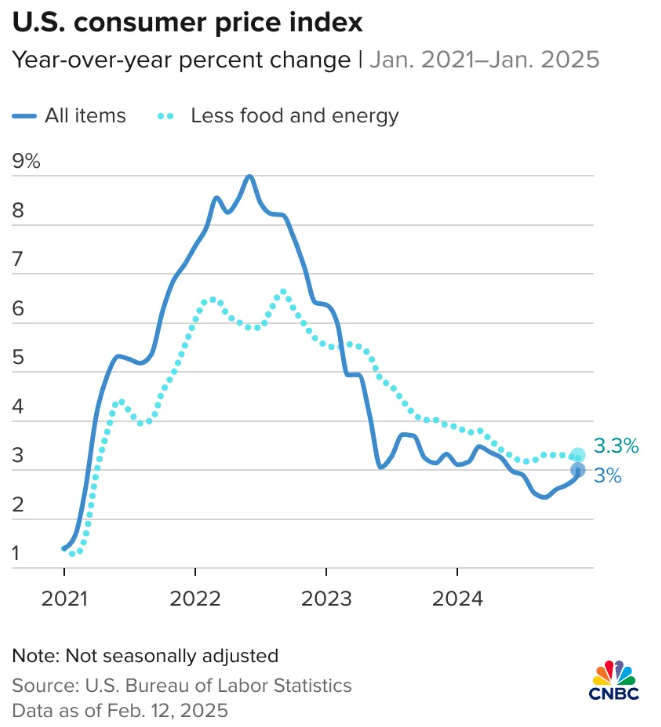

American inflation in January was higher than expected, immediately leading to a discussion about the consequences of monetary policy. This is because the stock market's valuation above a ten-year interest rate of 4.5 per cent (currently 4.47 per cent) becomes much more sensitive to interest rate movements. The higher inflation does not result from the sharp rise in egg prices. This increase can be attributed solely to the consequences of the bird flu. The problem is that there are too few eggs — a supply problem that the central bank cannot do anything about.

Multiple causes of rising inflation

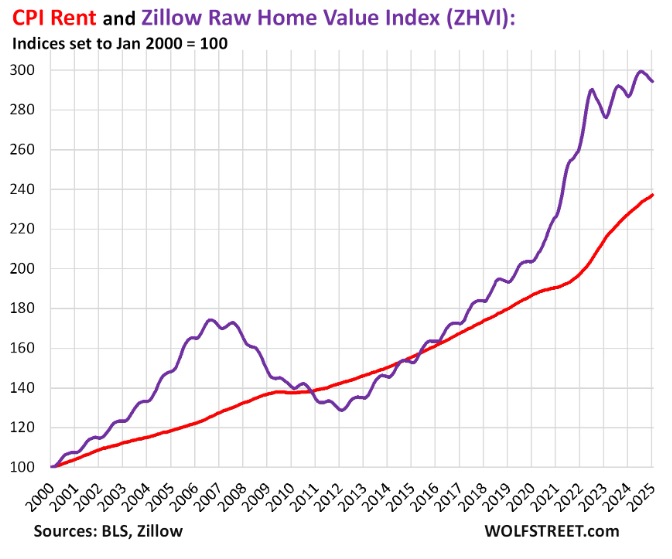

One cause is the still relatively high Owners’ Equivalent Rent (OER). Although this has fallen in recent months, it remains an important factor in why inflation remains above the target of 2 per cent. Furthermore, no American pays the OER directly; many still have their mortgages fixed at much lower interest levels. As a result, there is still a shortage of millions of homes in the United States, which has led to an increase in actual rents in recent months.

In addition, there were notable price increases for used cars, airline tickets and car insurance. Used vehicles only account for 2 per cent of the inflation index, but when their prices increase by 30 per cent annually, it has a measurable effect on the inflation rate. Insurance premiums for cars have also been rising for some time. This is mainly because modern (electric) cars are much more expensive to produce, partly because of the many sensors.

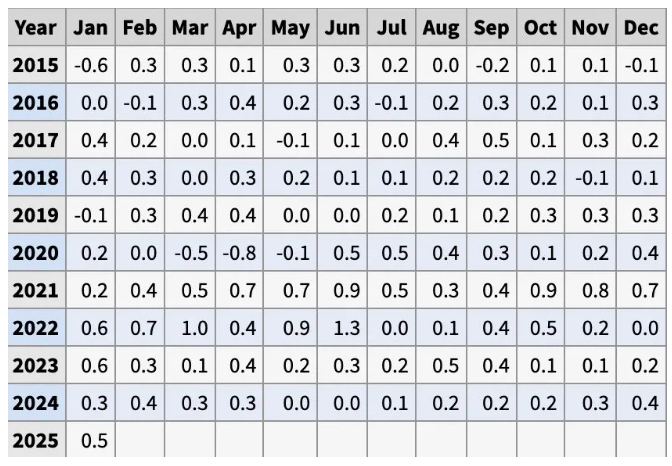

The January effect on inflation

Every year, there is also a so-called January effect on inflation figures. Usually, this seasonal effect is included in the calculations (although in 14 of the last 15 years, inflation in the US was higher than expected in January). Still, this is less easy due to the volatile inflation of the past few years.

The market hardly reacted to this inflation development. This is because expectations have already considered a possible interest rate increase. The market now mainly expects the key interest rate to remain at its current level for the time being. The chance of both an interest rate increase and a decrease has decreased. Therefore, the recent rise in interest rates is more due to the real interest rate than to inflation expectations.

Inflation 2025 and the stock market

When the Federal Reserve became less dovish at its December meeting, interest rates rose above the 4.5% mark. The correlations between equities and interest rates reversed to firmly negative territory, which has remained ever since. In other words, interest rates no longer support higher valuations, which have been an essential driver of returns in recent years. Instead, corporate profits are now the primary driving force behind returns, which will likely remain the case. While the Fed was already becoming less and less dovish, last week’s uncertainty about rates and inflation figures could reinforce that shift.

The bond market is currently pricing in just over one rate cut for the rest of the year. June is now the earliest that markets expect a cut, but this depends on further inflation developments.

Political influence on inflation

Other macro-economic developments that influence share prices are the various policy measures of the White House, such as import tariffs, stricter immigration enforcement and cost-saving measures (DOGE) by the Ministry of Finance. We expect tariffs to have a more isolated impact on the stock market. However, if import duties are imposed on China, Mexico and Canada until 2026, the impact on the consensus profit expectations of the S&P 500 will be around 5–7% — not a negligible factor.

A lower immigration supply seems more likely to influence total demand than to lead to higher wage costs for listed companies directly. Finally, there is much scepticism about the Ministry of Finance’s ability to reduce federal spending substantially. This pessimism is probably unjustified, but it should be realised that short-term success can be a growth inhibitor. At the same time, it has a positive effect in the longer term through lower budget deficits and less crowding out of the private sector. This could lead to more interest rate cuts by the Fed and a decline in long-term interest rates.

Furthermore, ending the war in Ukraine would be positive for inflation simply because wars always have an inflationary effect. However, the (European) army will have to be expanded, and a large part of the reconstruction will have to be financed by Europe.

Conclusion: Inflation 2025

The increase in import tariffs functions as an additional tax on consumption. Such a tax does not cause more inflation but rather less. However, the costs of import duties do not have to be fully passed on to the consumer. For example, a large part will be absorbed in the supply chain through lower profit margins. In addition, companies will immediately start looking for alternative suppliers.

Instead of raising inflation, higher import tariffs mainly cause trade disruptions, which means they impact economic growth more than inflation. In the longer term, disinflation is likely partly due to increased productivity growth.