Peak political uncertainty

2024-11-05

BY CHELTON WEALTH

Peak political uncertainty

The best election outcome for the stock market is a ‘Republican Sweep’, in situation where Trump becomes the next president and where the Republicans gain the majority in the US Congress (Senate plus House of Representatives). There are many issues at stake this Tuesday, but for financial markets, there are essentially five components at stake: taxes, deregulation, the budget deficit, import tariffs and immigration. Making some changes in the first three requires the president to get the support of Congress.

Taxes

In Trump's first term, taxes were cut, and, as a result, earnings valuations went up. Rising stock prices almost always accompany rising earnings valuations. This time, Trump wants to cut corporate taxes from 21 per cent to 15 per cent, but Harris wants to raise those same taxes to 28 per cent. Harris wants to raise taxes because that is ‘fair’ and everyone should contribute. Taxes on corporations ultimately have to be paid by someone, and that is the consumer. Ultimately, only consumers pay taxes. The government uses businesses to collect extra sales tax, reflected in a higher consumer price.

Deregulation

Less regulation is almost always good for businesses. Europe is a good example of how rules can be stifling. Large international companies, in particular, benefit from excess regulation because it becomes harder for smaller companies to compete. Too many rules create implicit monopolies. Fewer rules create more competition, and more competition creates innovation. More competition also ensures lower prices for consumers. Instead of appointing even more compliance officers, capital can be used to invest in research and development.

US budget deficit

With both candidates, the budget deficit is rising. This does require a majority in Congress. At the moment when Harris faces a Republican majority, Congress keeps its hand on the purse strings. Suddenly, Republicans turn out to favour a balanced budget again. Think of the Tea Party. When Trump faces a Democratic Congress, there will likely be room to talk to the Democrats about more government investment. That public investment increases even more if there is a Democratic sweep. Even with a Republican Congress and president, the budget deficit remains high. Only with the Republicans is this due to lower taxes, with the Democrats mainly due to a government with more to spend.

Import tariffs

The essential difference between Republicans and Democrats when it comes to import tariffs is that Democrats have so far used them mainly from a neoconservative perspective. Democrats only talk to other countries if that country is a democracy. If that fails, import tariffs are mainly there to impose the US will on that country. Eventually, a US invasion, like in Iraq and Afghanistan, follows to export US democracy to the rest of the world. Now, neoconservatism was no stranger to Republicans either, but Trump is much more deal-oriented. Trump uses tariff walls mainly to secure a deal favourable to the US. That means that for other non-democratic countries, there is room to negotiate bilaterally with Trump, but probably not with Harris (perhaps because it is not yet clear whether neoconservatives like Blinken and Sullivan will return to the White House). By the way, higher tariffs do not cause more inflation but possibly recession (see the examples from the 1930s).

Immigration

The number of migrants has doubled under Biden. That means cheaper labour and more consumers. Therefore, from an economic perspective, immigration is a positive development. Any business will be happy to see more cheap labour available, and any business would also rather see more than fewer customers. The US economy will be negatively affected when Trump closes the borders. But this can easily be offset by lower taxes, deregulation and the economic boost of an even higher budget deficit.

Conclusion

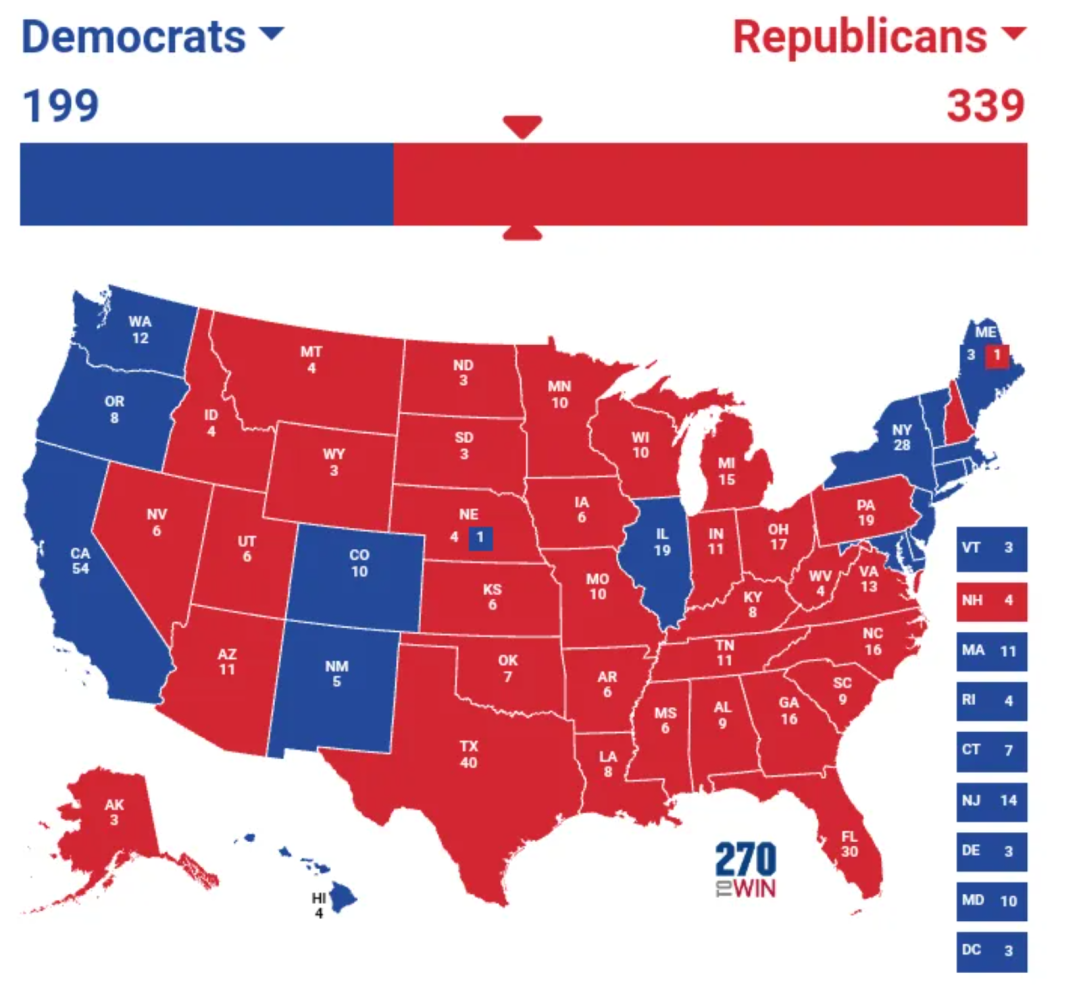

When Trump faces a Democratic majority, he will not have ample room for lower taxes, deregulation, and higher government spending (the latter perhaps partly as a compromise). However, he does have the option of closing the borders as president. On balance, this is not good for the economy or the stock market—the moment Harris faces and Republican majority that looks more like the current status quo. However, if Harris has Congress with him, count on higher taxes and more regulations. Negative for the economy, partly offset by more immigration.

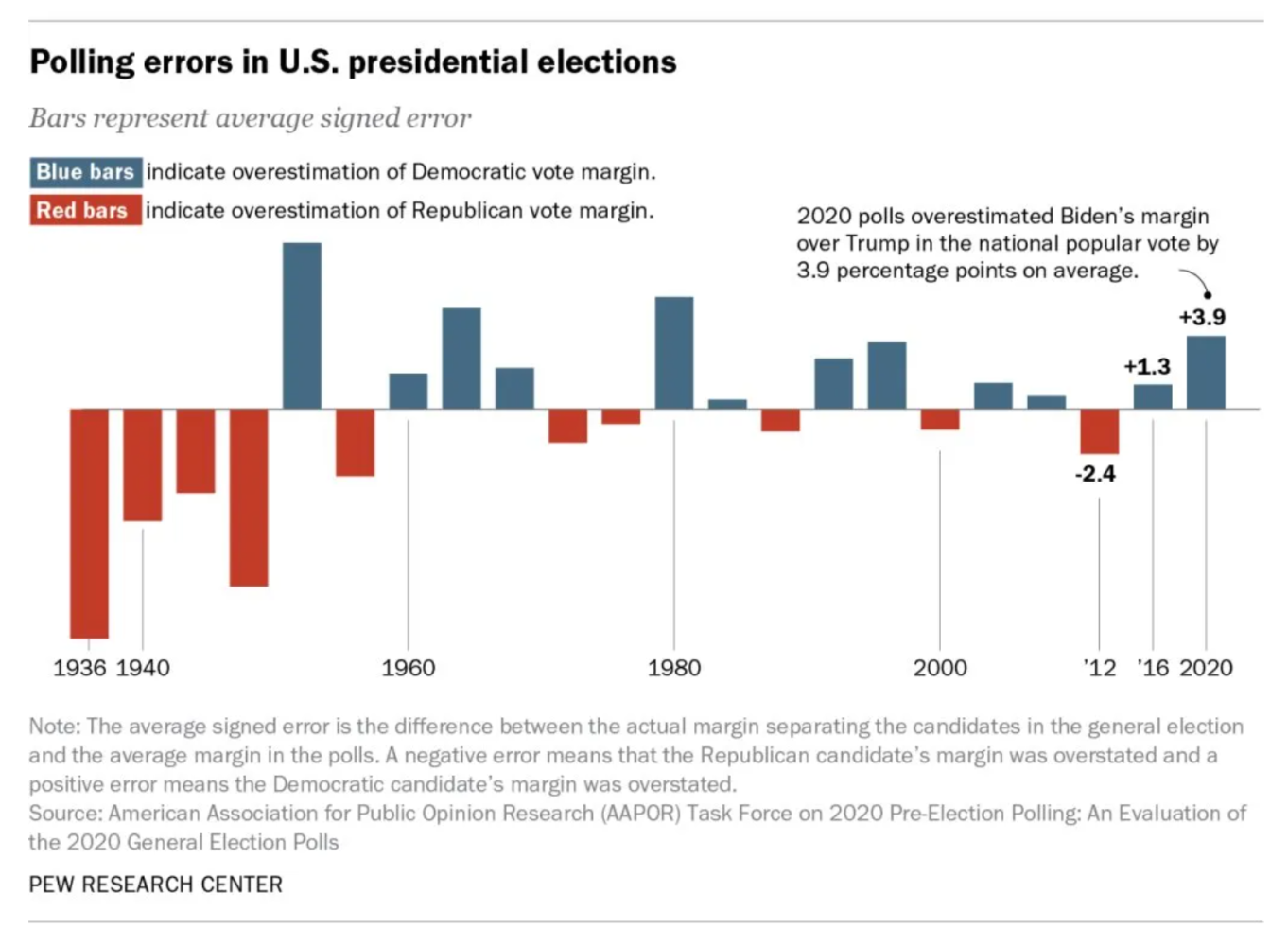

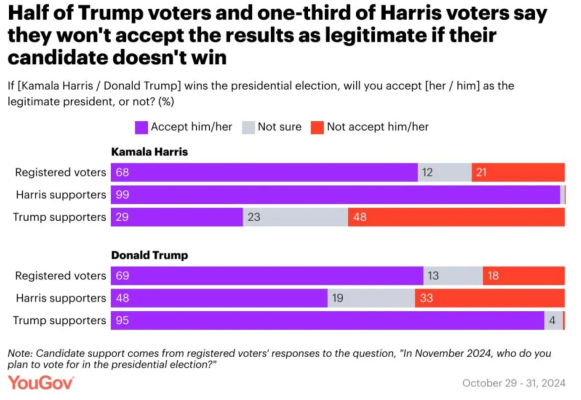

The most negative scenario for elections is when the differences in the results are so small that the loser sees room to contest the result. In 2000, the votes in Florida had to be recounted, and Bush eventually won, even though Al Gore had the majority in popular votes. That caused a delay then. In today's polarised America, any recount could quickly escalate. Normally, elections bring clarity and reduce uncertainty. That is likely to be the case this time, too. The result is a rising stock market. Only if gridlock persists is that a negative development.