The next euro crisis

2024-04-24

BY CHELTON WEALTH

The next euro crisis

The euro crisis ended in July 2012 thanks to Mario Draghi’s bumblebee speech. In it, he indicated that markets would underestimate the political capital poured into the euro project. In the end, Draghi saved the euro by stating that the ECB would do everything possible to save it. That speaks for itself; without the euro, there is no ECB. Without the euro, the current European Union will also cease to exist. Draghi argued that the introduction of the euro is irreversible. Yet several currency unions have fallen apart in the past. Countries may be unable to leave the euro, but the euro could cease to exist. The big advantage is that the European Union 2.0 could be twice as big, including the United Kingdom, Switzerland and Norway.

Euro project not yet finished

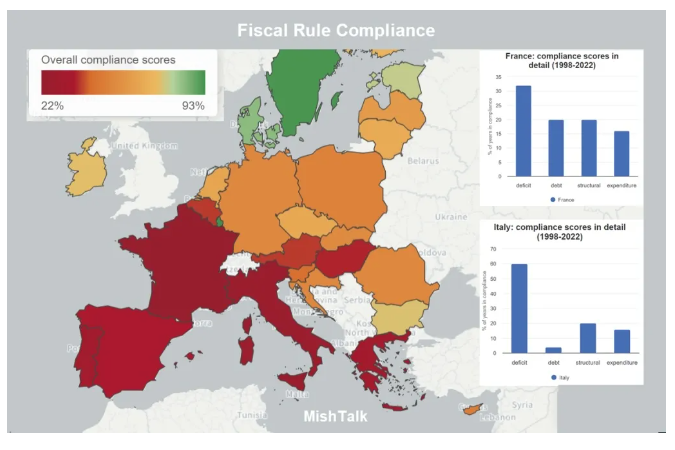

The dilemma with the euro project is that it still needs to be finished, creating more divergence within the eurozone. The differences between countries are widening, not narrowing. This creates tension, which comes out especially during downturns. That is also the time when Europe must manage to implement reforms. For the euro to change better in the Union, more power has to go to Brussels, but for that, European countries have to give up power, much power. As long as that has not happened, tension will remain that could culminate in the end of the currency union.

Loss of competitiveness

The European economy may be doing somewhat better, but the Union has been dealt a severe blow by the coronavirus crisis, especially the war in Ukraine. While we are no longer dependent on Russian oil, energy is much more expensive in Europe than in other countries, and combined with high wages, this hits our competitiveness. Now, we have to pay for energy with dollars that we first have to earn, after which we mainly rely on LNG.

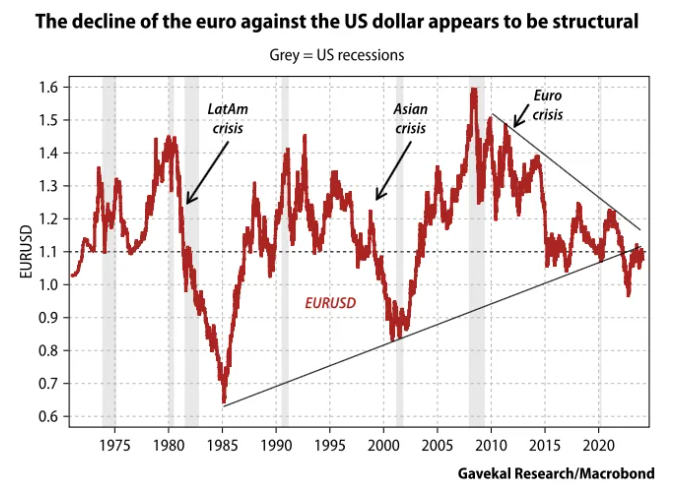

Weak euro signals next crisis

The strength of a currency ultimately depends on the strength of the economy. The euro itself is a good indicator of future problems. Now that the euro is relatively weak, although any euro optimist will immediately add that it is still higher than when it was introduced. The reason the euro was weaker than it had anything to do with the Asia crisis just before. Until the Great Financial Crisis, there was still hope that the euro would be an alternative to the dollar as a reserve currency. That is no longer the case, and after the monetary madness of the past few years, the chances of that happening are very slim.

The Berlin-Paris axis

In 2012, the problem was Greece. The size of the Greek economy made that problem manageable. If it had been Italy, the euro would not exist now. This time, the weak euro is not the result of developments in Greece or Italy. The problem this time is much more at the heart of the European Union. German industry has taken big hits in recent years. Germany has to compete against Japan with a much weaker Japanese yen. The German car industry has lost out to Chinese exports in the electrical field. German chemicals can be produced much cheaper outside the Union. Germany must now do all it can to save its economy.

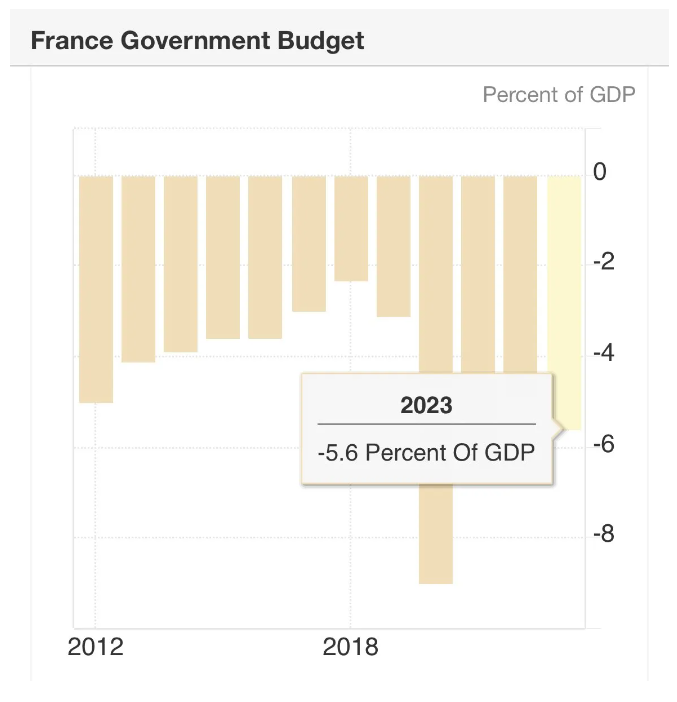

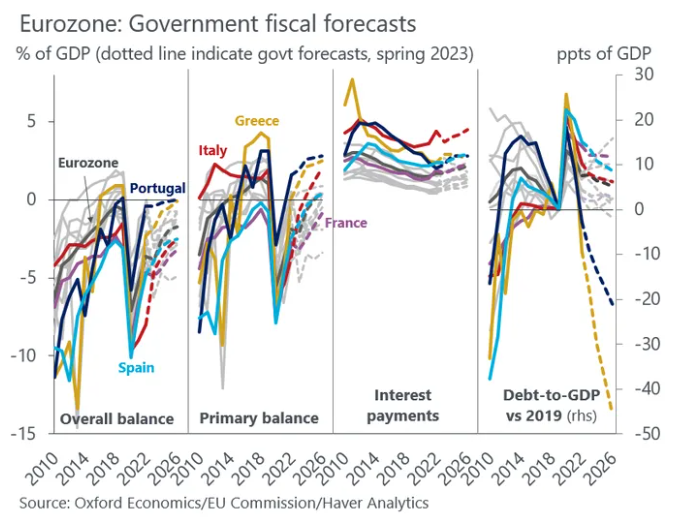

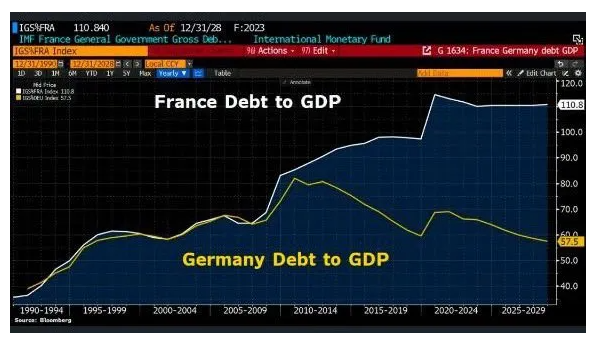

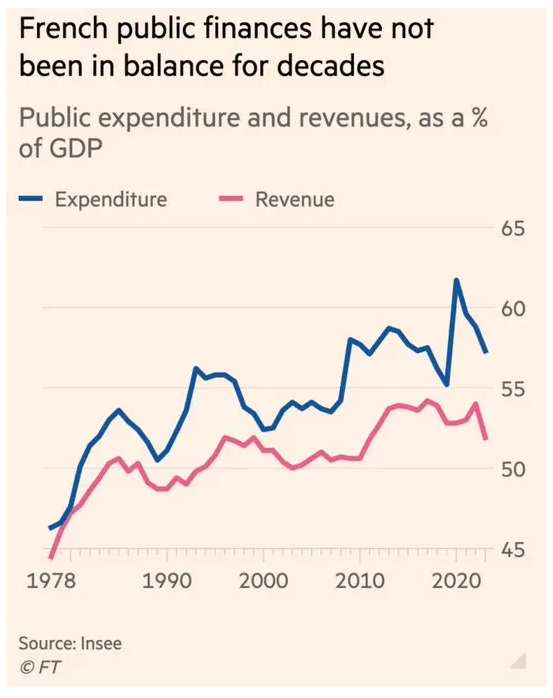

France’s risk

France was always just one recession away from Italy. The difference between France and the southern member states is that countries like Greece and Portugal have primary surpluses that allow debt to fall sharply as a percentage of GDP. France has been running deficits since 2007, so its debt as a percentage of GDP is rising. Germany is now in the middle, so it can no longer lecture the rest of Europe. That means Germany can no longer bail out France if things go wrong. Because of the mounting debt, Fitch downgraded France last year, and Standards and Poors now have France “under review”. Should problems arise that cause interest rates to rise in France, it will be challenging to finance France. Now, let’s hope enough political capital is left to keep the currency union afloat.