European elections

2024-06-05

BY CHELTON WEALTH

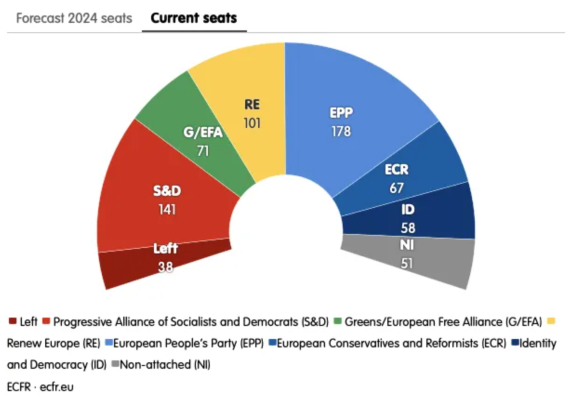

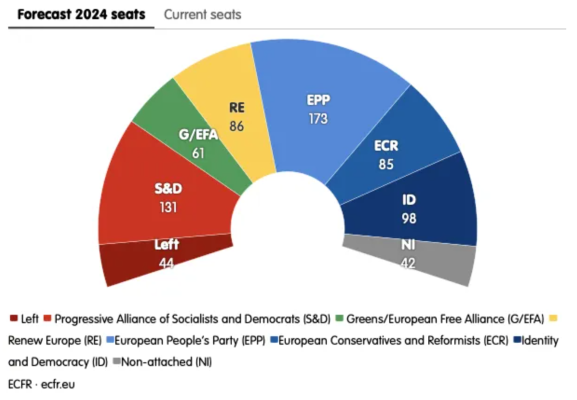

On June 6, there will be elections to the European Parliament. This time, the elections will show a major shift to the right in many countries, with populist right-wing parties gaining votes and seats across the EU and centre-left and green parties losing votes and seats. Anti-European populists are likely to top the polls in nine member states (Austria, Belgium, Czech Republic, France, Hungary, Italy, the Netherlands, Poland and Slovakia) and come second or third in another nine countries (Bulgaria, Estonia, Finland, Germany, Latvia, Portugal, Romania, Spain and Sweden). In the European Parliament, a populist-right coalition of Christian Democrats, conservatives and radical-right MEPs could win a majority for the first time. This right-wing coalition is likely to have significant implications for policy at the European level, affecting the foreign policy choices the EU can make, particularly on the environment, where the new majority is likely to oppose ambitious EU measures to address climate change.

More power back to member states

Given the Euroskepticism of many right-wing parties, we could see majorities in the next parliament for more freedom for member states. This bloc would likely vote against committee proposals to enforce common rules and instead side with the growing group of national governments - such as those in Hungary, Italy, Slovakia and Sweden - pushing for less interference from Brussels in national economic, fiscal and regulatory policies.

Capital markets union required

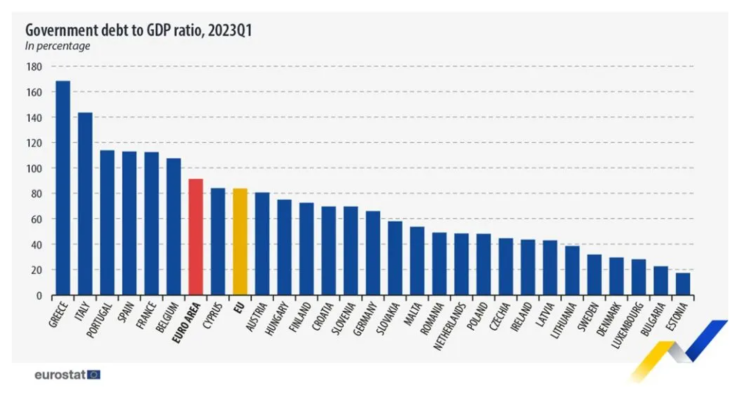

Since the start of the corona pandemic, Eurozone GDP has grown by 3.4 percent, less than half of the 8.7 percent growth in the US. French President Emmanuel Macron warned that Europe is “mortally threatened” by economic decline. The EU should move ahead with the much-discussed capital markets union as a solution. It would make the EU more stable, resilient and competitive. Such a capital market requires a European homogeneous risk-free alternative, similar to treasuries or bunds, but such a thing does not yet exist or is insufficient. In times of crisis, everyone flees into German Bunds, and the differences between countries increase. For such a European capital market to succeed, budgetary power must be given to Brussels; right-wing parties do not want that. There are alternatives to this, but the various parties must want them.

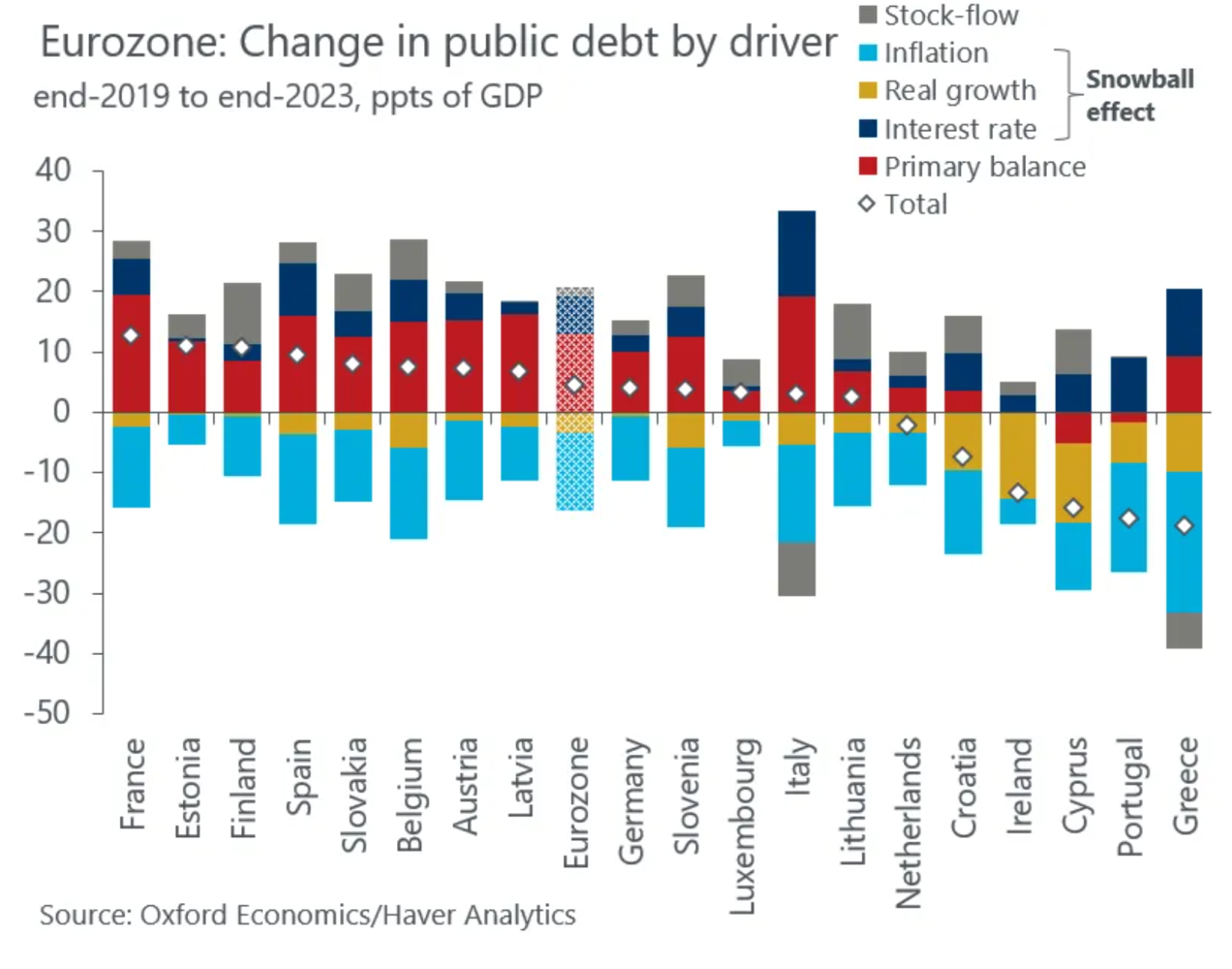

European core countries in trouble

Cyclically, things are improving somewhat in Europe, but structurally, core countries Germany and France are now in trouble. This could put further pressure on the euro. In the long term, the euro versus the dollar has been falling since 2009. The shine of reserve currency next to the dollar has now faded. Nevertheless, the euro is still firmly overvalued against, for example, the Japanese yen or the Chinese renminbi. Europe's competitiveness has deteriorated recently due to expensive energy and high wages. There is a risk that interest charges on the accumulated public debt will rise sharply and, with it, budget deficits. Macron's party looks set to lose heavily in the European elections, which will cause more political instability in France, possibly even in the case of new elections. Ultimately, it could weaken France's position within the EU. At the same time as the elections, the ECB will cut interest rates for the first time. In doing so, the ECB is moving ahead of the Federal Reserve for the first time. There is a risk that the Fed will keep interest rates high for longer, and the ECB will have to be very bold in making a second move ahead of the Fed. Otherwise, there is a risk that the euro will quickly reach parity with the dollar, witnessing a significant shift to the right in many countries, with populist right-wing parties gaining votes and seats across the EU and centre-left and green parties losing votes and seats. Anti-European populists are likely to dominate the polls in nine member states (Austria, Belgium, Czech Republic, France, Hungary, Italy, the Netherlands, Poland and Slovakia) and secure second or third positions in another nine countries (Bulgaria, Estonia, Finland, Germany, Latvia, Portugal, Romania, Spain and Sweden). In the European Parliament, a populist-right coalition of Christian Democrats, conservatives and radical-right MEPs could secure a majority for the first time. This right-wing coalition is likely to have a significant impact on policy at the European level, influencing.