The impact of a trade war

2024-06-18

BY CHELTON WEALTH

A key part of Trump's campaign this time is a new round in the trade war, namely a 60 per cent increase in all tariffs. While economist panels argue that this will cause inflation, this is unjustified. A trade war and protectionism are bad for the Chinese and US economies. In the past, this very protectionism caused recession. This does not fit inflation but deflation.

Origins of the trade war

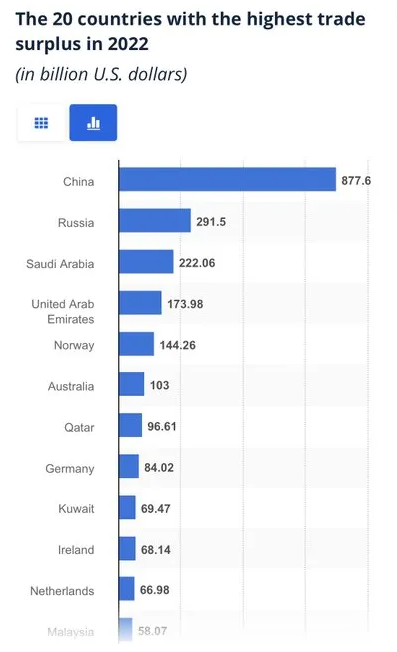

During the 2016 presidential campaign, Trump pointed to US trade with China. This, he said, was the main cause of job losses and intellectual property losses. China was said to be responsible for ‘the biggest theft in the history of the world’ and denounced the US trade deficit with China, which amounted to about $346 billion in 2016. Building on Trump's image as the ultimate dealmaker, he devised a strategy to reform the US-China trade relationship, promising a better deal with China that helps US companies and workers compete.

Trump's plan

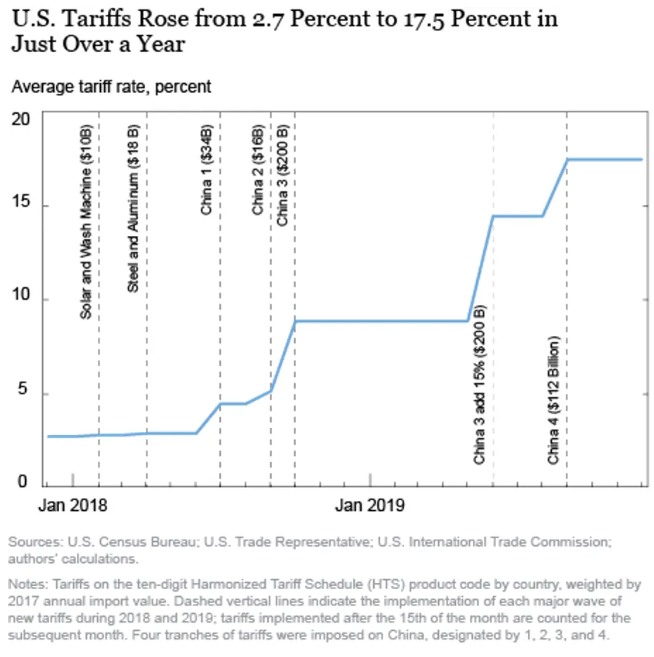

Trump came up with a four-part plan to secure a better deal with China: Declare China a currency manipulator; confront China over intellectual property and forced technology transfer concerns; end China's use of export subsidies and lax labour and environmental standards; and lower the US corporate tax rate to make US manufacturing more competitive. The trade war put pressure on China. Between July 2018 and August 2019, the United States announced plans to impose tariffs on more than $550 billion of Chinese products. China retaliated with tariffs on more than $185 billion of US goods.

Economy under pressure

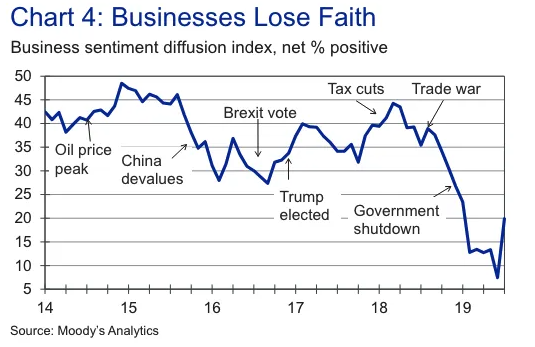

The trade war caused economic pain and diverted trade flows away from China and the United States. US economic growth slowed, business investment froze, and companies hired fewer people. Across the country, many farmers went bankrupt, and the manufacturing and trucking sectors reached lows not seen since the last recession. Trump's actions amounted to one of the biggest tax hikes in years.

A September 2019 study by Moody's Analytics found that the trade war had already cost the US economy almost 300,000 jobs and an estimated 0.3% of real GDP. Other studies estimated the cost to US GDP to be around 0.7%. A 2019 report by Bloomberg Economics estimated that the trade war would cost the US economy $316 billion by the end of 2020, while more recent research by the Federal Reserve Bank of New York and Columbia University found that US companies lost at least $1.7 trillion in recent years due to US duties on imports from China.

Democrats are even tougher on China.

Interestingly, the only part on which Democrats and Republicans agree is the approach to China. This is probably also the reason why Democrats are trying to outdo Trump on this issue with an even tougher approach to China. After all, it falls well with all voters. Before Trump's arrival, the idea was that by allowing China to join the World Trade Organisation, a richer and developing China would automatically become democratic.

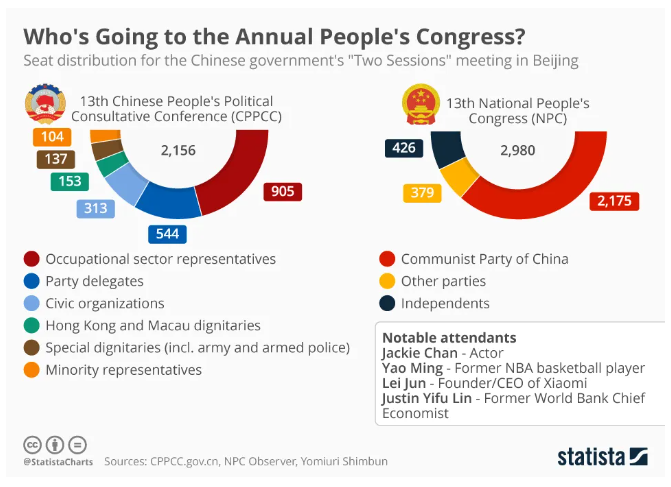

Chinese Democracy

China does see itself as democratic, and in some ways it is. The Chinese parliament (People's Congress) is the largest in the world, and its members are mainly the local rulers of the various regions. They are not elected but are responsible for that region. If something goes wrong somewhere in China, Beijing is rarely blamed but is always the region's representative. While any uprising is put down hard, the rulers in Beijing punish local rulers for their failures.

As a result, some power lies with the people, whereas local rulers in a Western democracy often get another job after failure. Yet the Chinese conception of democracy is incomparable to our views. Part of the Chinese social contract is that while the people are allowed to get rich, they must sacrifice privacy and freedom in return. China also has no democratic tradition; Xi is yet another emperor.

Not inflation, but deflation

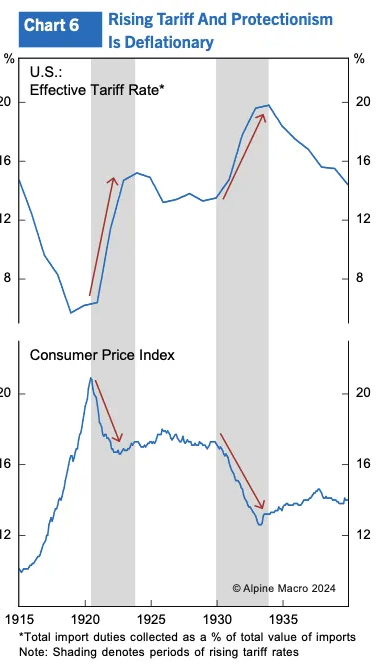

This is not the first time the United States has raised import tariffs. While many economists intuitively think this causes higher costs and, hence, higher prices, the opposite is true. In the 1920s and 1930s, the United States raised import tariffs twice. This caused prices to fall each time because those higher prices inhibited the economy. This was also the case during Trump's first term. Businesses did not charge any tariffs, but it came at the expense of profit margin.

So if Trump gets a second term and does what he promises (raise tariffs by 60 per cent), it will not mean more inflation, but the shock might be big enough for a recession, causing prices to fall. Moreover, the business community is already working to avoid any shock of higher import tariffs by trading more with countries like Vietnam, Laos and Cambodia, which ensures lower prices. China is trading more with emerging markets (The Global South), and emerging markets are trading more with the US. Incidentally, Biden is currently ahead in the polls, but the election is still far off.