Best Year of Election Cycle

2024-01-11

BY CHELTON WEALTH

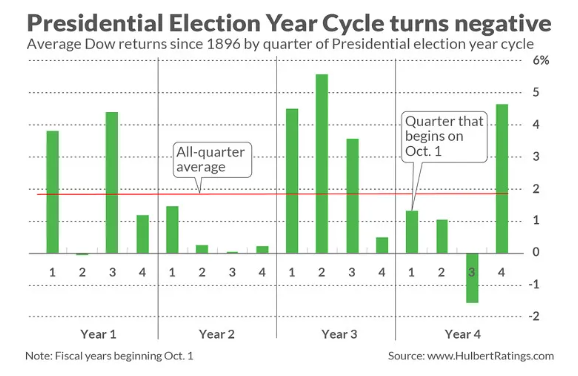

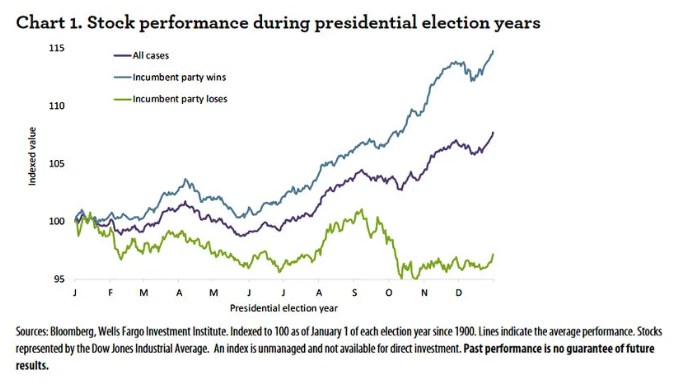

The third year of the US presidential cycle is usually the best. Along with the fourth year of this cycle (2024), the second half is much better than the first two years. The thinking is that the incumbent president will do everything possible to grow the economy before the election, increasing the chances of victory. This theory can be substantiated with data from presidential cycles over the past 70 years. The effect may have increased somewhat since Clinton’s victory over Bush senior, “It’s the economy, stupid” after all, stated James Carville, strategist with Clinton’s campaign team.

THE FED IS NOT ALWAYS INDEPENDENT

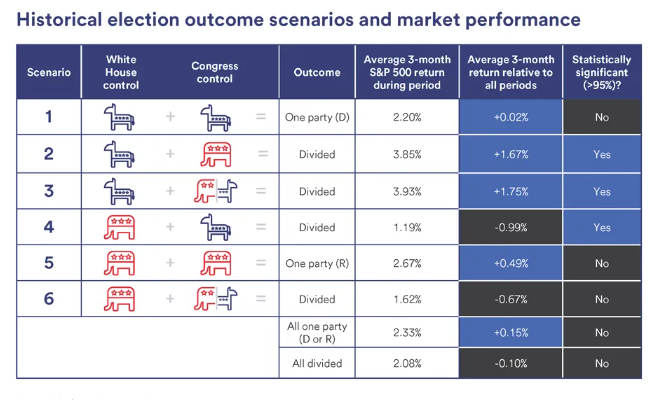

The question does arise whether the US president has enough power to influence elections. Of course, it helps if Congress is the same colour as the president. Even more influential on the economy is the central bank. Politicians regularly want to influence monetary policy, but the Federal Reserve values its independence. Only once did the Fed overtly change its policy to ensure a candidate could win. In 1972, Fed chairman Arthur Burns kept interest rates low to ensure that Nixon would be re-elected. In other elections, there seems to be no connection between Fed policy and the election.

CANDIDATES TAKE ADVANTAGE OF MONETARY POLICY

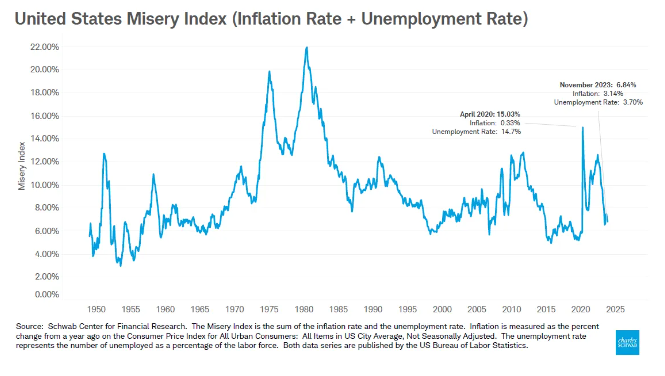

Again, the Fed should pursue its targets, including a 2 per cent inflation rate combined with maximum employment. This time, the central bank’s credibility is also at stake. For a long time, the Fed stuck to the ‘longer low’ policy, calling inflation transitory. In hindsight, much of the inflation was indeed transitory, but the ‘longer low’ policy helped contribute to the banking crisis in early 2023. In some ways, the late intervention resembled Paul Volcker’s policy. That raised policy rates sharply in 1980 to combat high inflation. Candidate Ronald Reagan made good use of this by pointing to the misery index (unemployment and inflation rates) tobeat Jimmy Carter. The most significant election-time rate cut was in 2008 when Barack Obama won the election during the Great Financial Crisis.

FED’S TURN COMES AT A SPECIAL TIME

The Federal Reserve’s December pivot, in which financial markets were immediately presented with three interest rate cuts by 2024, was prompted by the remarkably rapid fall in inflation. Just about every inflation figure surprised on the downside over the past 12 months. Still, the Fed’s pivot does come at a special time. Usually, the Fed pivots when stock markets fall or unemployment rises sharply. That is not the case now. The stock market is trading close to an all-time high, and unemployment — especially in a historical perspective — is still low.

It could be that the market has not understood Powell correctly and that he is still sticking to his ‘longer high’ policy. It is also possible that the Fed sees something the market does not, which is a relatively rapid slowdown in the US economy. After all, a short-term recession is an excellent reason for the central bank to cut interest rates.

POLITICAL INFLUENCE ON THE ECONOMY IS GREATER THAN BEFORE

Politics will also have a greater influence on monetary policy this time. In 2024, consumers will still be in good shape, and the fiscal government will still be stimulating the economy. Lower oil prices, a still-tight labour market, a weaker dollar, and pro-cyclical monetary policy help that economy. The election circus could prompt the Fed’s turn.

The US economy is running like clockwork; full employment and nominal GDP growth over the last few quarters has been spectacularly high. This is all made possible by exuberant fiscal policy. Until the Great Financial Crisis, monetary and fiscal policies moved in tandem, and there has been an opposite policy since then. While the Federal Reserve is trying to put the brakes on the US economy, fiscal policy is geared towards maximising stimulus and thus frustrates monetary policy. In any case, it is an excellent argument for keeping interest rates high for longer.

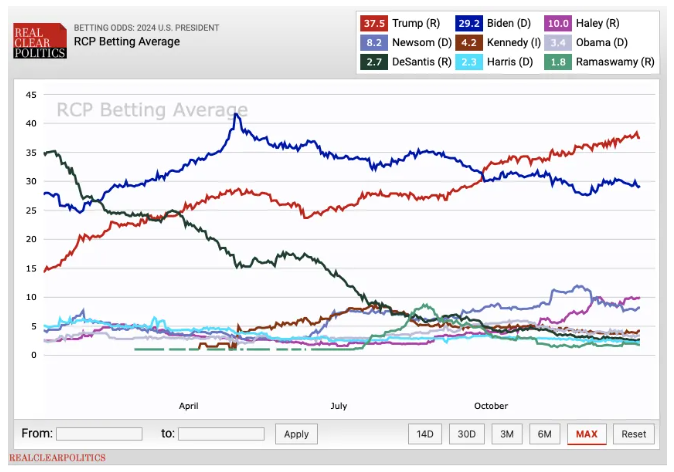

WASHINGTON FEARS TRUMP

For officials in Washington, this election is different from previous elections. Candidate Trump is threatening to come clean in Washington, and he holds the federal government responsible for defeating him in 2020 (in his terms: that the election was stolen). Fed members are also unlikely to be waiting for another four years of Donald Trump, a man known for firing people on the spot.

Curiously, no one asked Powell whether the three interest rate cuts announced might not be premature. Everyone is more likely to assume that the Fed is too late and that more needs to be done to support the economy. Both the Fed and the fiscal government are easing in 2024. Much is being done to keep energy prices low. The three interest rate cuts announced made for a weaker dollar, something that worked out particularly well for Democrats.

UBER-GOLDILOCKS

Taken together, this is not a recipe for a recession in 2024. If Trump’s tax cuts and deregulation are added on top of that, it already seems that growth expectations for the US economy in the coming years have been underestimated. With low interest rates, we are soon in the Uber-Goldilocks scenario, provided that inflation does not throw a spanner in the works later this decade.