Year of elections

2024-07-01

BY CHELTON WEALTH

Year of elections

In the past, elections were mostly a non-event for financial markets. Of course, sectors always benefited more when a particular party won the election, but by and large, there was more of an evolution than a revolution. That has now changed. Globalisation has many winners but also some clear losers. That is the middle class in developed markets. That middle class has to compete with the emerging middle class, mainly in Asia. This is increasingly unsuccessful, and, as a result, discontent is rising. It has also created polarisation between the elite and the people, not between left and right. Populists have gratefully exploited this, and because of this dichotomy between the elite and the people, the outcome of elections is increasingly causing bigger policy changes.

Most elections ever

Never before have so many elections been held in a single year as in 2024. The French parliamentary elections recently joined this, but by early 2024 it was clear that the US presidential election would have the biggest impact. The French elections could still lead to a euro crisis and for India and Mexico it was different from what was expected but the economic impact has been small. In the United States, it is different and this is partly due to the high level of polarization.

Can Trump surprise again?

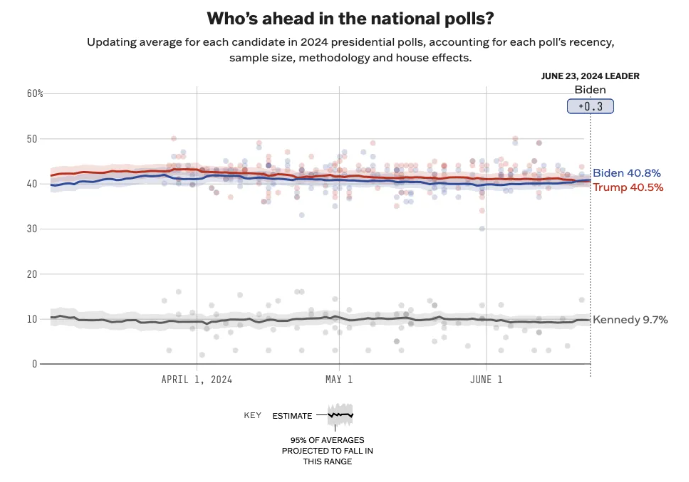

The last time Trump became president was a surprise, even for Trump. The market reacted quickly because Trump’s policies had far-reaching positive consequences for the economy, financial markets and investors. Deregulation, lower taxes, and a level playing field in international trade benefited the US economy. This time, it will probably become clear sooner who is the likely winner of the US election. At first, Trump was in the lead, but gradually, the cards improved for Biden. Recently, Biden has been leading, and with the help of Taylor Swift, he might win. Tomorrow, there will be a debate on CNN (27 June), but, likely, financial markets will not start considering the likely outcome of the election until after the two parties’ conventions. First is the Republicans’ convention in mid-July, then the Democrats’ in mid-August.

Market price result as soon as possible

The US stock market normally performs above average in election years. There is also a summer rally, which is held regularly in election years. If there is a correction in an election year at all, in retrospect, it is more likely to be linked to a recession than to a particular candidate’s win. However, given the growing global economy, a recession is less likely in the short term. This time, it is likely to become clear at an earlier stage who may claim the win, and the market will then discount that for November. Should Trump win, energy, aviation, defence, and finance sectors will benefit. If Biden wins, alternative energy stocks, healthcare and consumption-related stocks will benefit. Financial markets seem to favour Trump, given his pro-business approach. But of course, he is often dependent on a majority in Congress on issues like taxes and regulation, and that outcome is likely to be uncertain for some time.

Possible deal with China

Trump is threatening a 60 per cent increase in import tariffs. That does not seem good for China, but the fact is that Biden is much tougher on China than Trump. This is striking because, as president under Obama, Biden got along well with the Chinese. Because an anti-China policy goes down well with Republican and Democratic voters, the main issue is an escalation of increasingly tough measures and higher demands. However, in reality, Trump is not concerned about a level playing field but more about a good deal for the United States. Trump may make such a deal with the Chinese. Trump is also likely to be more pragmatic than Biden. Furthermore, it will likely be a remarkably smooth transition this time, especially if Trump is allowed to win, with the constant factor being a rising budget deficit.

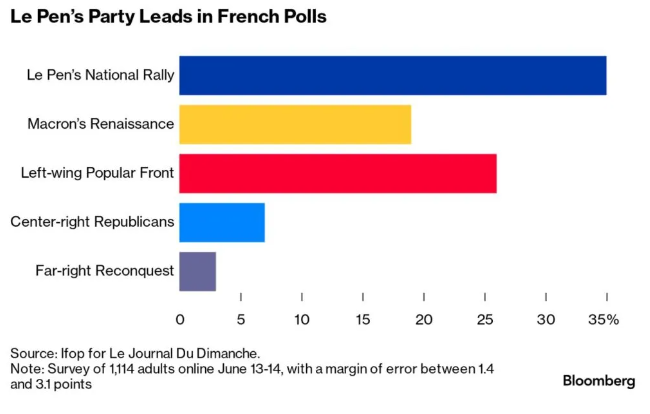

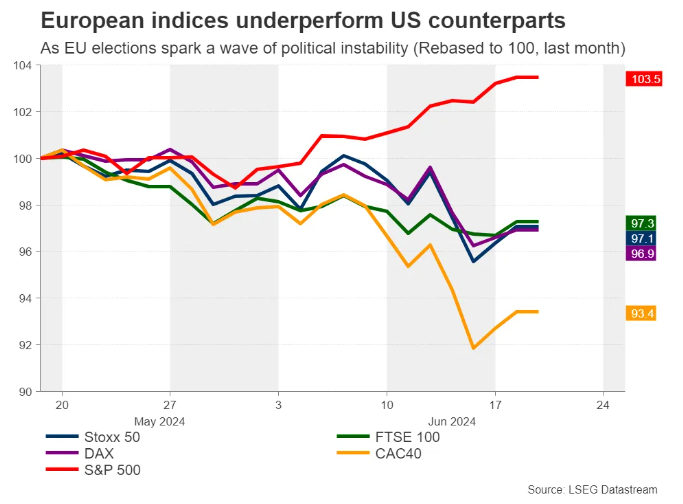

The sixth French republic

Macron called for new parliamentary elections after the European elections, in which right-wing parties gained considerable ground, as expected. In France, parliament and the president are elected separately. Since the fifth republic (1958), the president has gained more power thanks to De Gaulle, but as in many other countries, it is nice to govern when the parliament and the president are of one colour. Macron is in office for another three years but hopes to win over more parties (other than Le Pen) with these by-elections. Or Macron should count on Le Pen’s party making a mess of things over the next few years so that he can gain popularity afterwards.

The coalition already lacked a majority

The coalition around Macron already did not have a majority in parliament and was unlikely to survive the budget talks. Elections are due on 30 June and 7 July. In the French district system, a candidate must get at least 50 per cent of the vote. If there is none in the first round, candidates who get at least 12.5 per cent can run for the second round. This system ensures that parties in the centre often emerge victorious, making it difficult for Le Pen’s RN to win a majority in many districts.

Fear of anti-capitalist left

The outcome the market fears most is not Le Pen’s win or a coalition with Le Pen and, of course, no win for Macron. What the market fears most is that the far left will become part of the coalition against Le Pen. Communists, Greens, and many socialists in France are pretty anti-capitalist. In this case, that means all of Macron’s reforms (pensions, labour market, etc) will be at stake, companies will be allowed to pay more taxes, and the government will spend much more than it brings in. It only becomes a problem for the euro once the ECB intervenes to finance France if France does not get its fiscal house in order. The ECB will then buy French government bonds to prevent further contagion. However, the chances of such a scenario are not that high, so the possession case ends entertainment in a few weeks.