US dept ceiling

2023-11-08

BY CHELTON WEALTH

The moment the US federal government runs a budget deficit, money has to be borrowed, usually in the form of government bonds (Treasuries). Before the year 1917, every new state loan had to be approved by the US Congress. This allowed the elected representatives of the people to keep a grip on spending. Because of World War I, the US government borrowed heavily. Procedurally, the situation was unworkable. Henceforth, the government was allowed to issue as many bonds as needed to finance the government. However, a ceiling was attached to this. That maximum is the debt limit (debt ceiling).

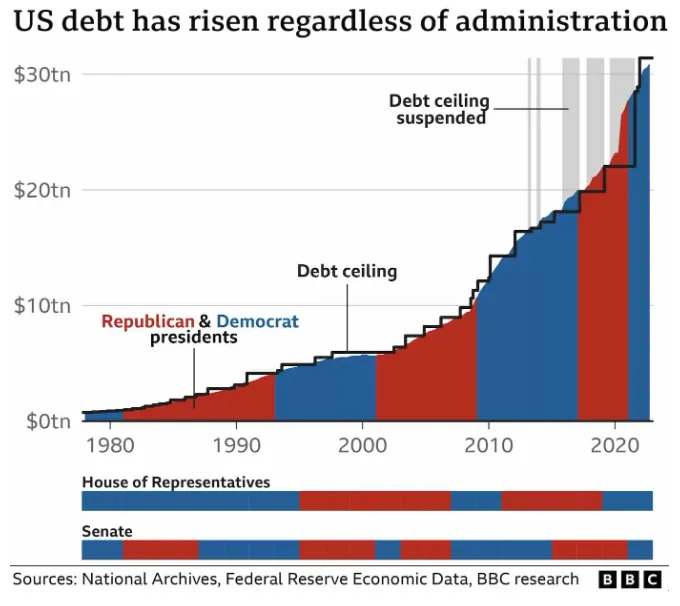

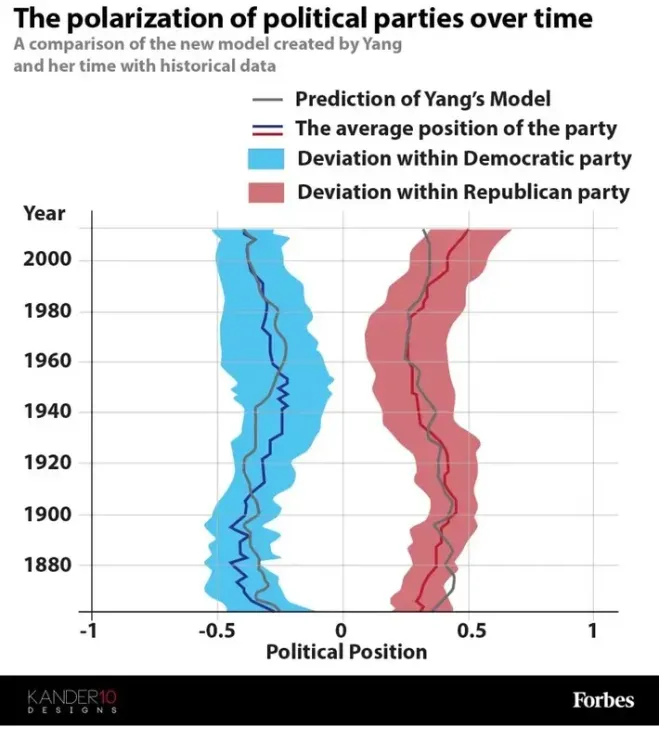

Since 1917, the debt ceiling has been raised some 80 times. Over the past three decades, this has become increasingly difficult. US politics is increasingly polarising. Agreement on a higher debt ceiling cannot be taken for granted. Especially the combination of a Democratic president with a new Republican majority in Congress regularly causes fireworks.

MID TERMS 1994

After the 1994 mid-terms, Democratic President Clinton faced a Republican majority in both the House of Representatives and the Senate. This Republican revolution sought balanced budgets as part of the ‘contract with America’. Clinton needed to bring down spending but blocked this with a veto. Then this fight continued through the debt ceiling. The US government shut down for five days. Speaker of the House Newt Gingrich even threatened a default for the first time in history. According to him, if Clinton did not give in to Republican demands, this would be a risk. The US government then shut down for 21 days.

MID TERMS 2010

After the 2010 mid-terms, Republicans gained a majority in the House of Representatives. Influenced by the Tea Party, Republicans again sought balanced budgets. Ahead of the debt ceiling deadline, the S&P 500 fell 17 per cent and interest rates rose. Standard & Poor downgraded the US credit rating from AAA to AA+ based on this stalemate. Just before the deadline, the Budget Control Act of 2011 was signed into law. Spending went down by 7 billion over 10 years and the debt ceiling went up by .1 trillion. That debt ceiling came into view again with the discussion on the Affordable Care Act (Obamacare) and the government closed again for 16 days. This year, Fitch also downgraded the rating for the US to AA+

POLARISATION

Given the increasing polarisation, a higher debt ceiling seems like an unattainable goal, but both parties must realise that the blocking party usually does not sit well with voters. Thanks to the mid-1990s blockade, Clinton subsequently won the election. In 2011, the Republicans may have been proven right about the debt ceiling. They could not benefit from that electorally. The current crisis resembles those of 1995 and 2011. The difference is that the small majority of Republicans in the House do not exactly ensure more stability. For instance, it took 15 rounds of voting to select the last speaker of the house. Yet last week, Republican Mike Johnson from the Trump camp became the new speaker of the house relatively quickly.

DEBT CEILING NEGOTIATIONS

Johnson must now ensure a deal on the debt ceiling within three weeks. To do so, however, Johnson must negotiate with the Senate in which Democrats hold the majority. The consensus in Washington is that Johnson is not going to succeed in reaching an agreement with the Democrats within three weeks. The alternative is to extend the negotiations. Only such a move is precisely the reason the last speaker of the house McCarthy had to step down.

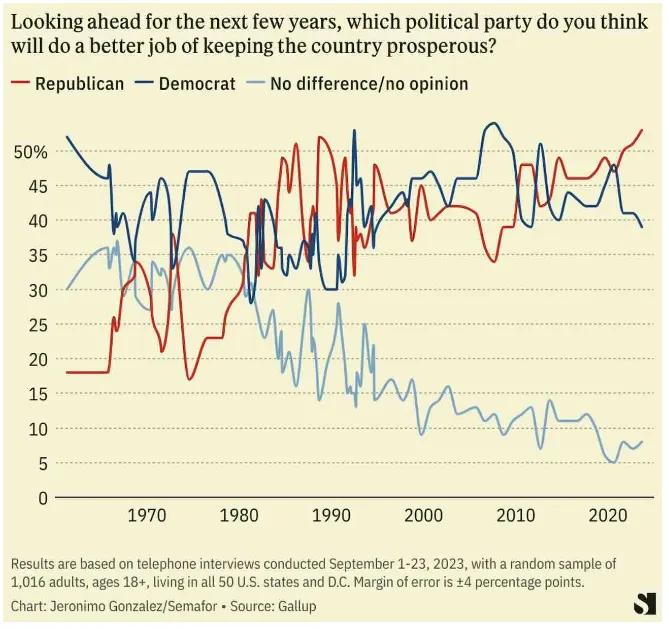

REPUBLICANS ON A WINNING STREAK

Another dilemma is that the Republicans have the wind at their backs electorally due to the terrorist attacks in Israel. Not only is Trump now almost certainly the candidate for the Republicans, he is also outpacing them in the polls. Biden has just hit a new low with an approval rating of just 37 per cent. Biden seems to have bet on the wrong horse with the friendly approach to Iran. In this regard, he has to hope for the recent questionable development in public opinion. As long as Israelis are victims, public opinion is fine with that. But as soon as they strike back, that sympathy disappears at lightning speed.

Also part of the debt ceiling is the Biden administration’s 6 billion request for military aid to Ukraine, Taiwan and now Israel. While there is widespread support among both Republicans and Democrats for Israel (the House of Representatives condemned the attacks by 412 votes to 10), some Republicans are starting to squeal about aid to Ukraine. Johnson now wants to split that request into two parts. Trump wants the Democrats to extend the five-year farm bill (which mainly benefits Republican states), which requires support from Democrats.

IMPACT FINANCIAL MARKETS

For financial markets, approaching the debt ceiling deadline on 17 November could cause more volatility. An additional problem is that when the government has to shut down, macroeconomic figures are also no longer published. That means the Fed has to sail in the dark at quite a crucial time. Furthermore, this may become the moment that the Democrats will lose the next election and thus markets will have to price in another four years of Trump.