The American bond market

2025-04-18

BY CHELTON WEALTH

The American bond market

According to the White House, the 90-day pause on import tariffs is part of a carefully thought-out strategy, but Trump himself said he only decided on this change of course on Wednesday morning, acting on instinct. His party members had to find out via Trump's Truth Social account. Even Peter Navarro seemed unaware of the decision. The result of Trump's U-turn is that we now know where his pain threshold lies. It is not so much determined by the fall in the stock market, but rather by rising interest rates.

US 10-year interest rate

Unusual market reaction

The US 10-year interest rate rose by 60 basis points in a short period, from 3.9% to 4.51%, while the dollar lost almost 3% of its value during the same time. This makes the United States look like an ‘emerging market’. Usually, the US dollar rises and interest rates fall in times of stress. The fact that the opposite is now the case is remarkable, to say the least. Recent auctions of U.S. government bonds have been met with remarkably low interest rates, which puts Finance Minister Scott Bessent in a challenging position.

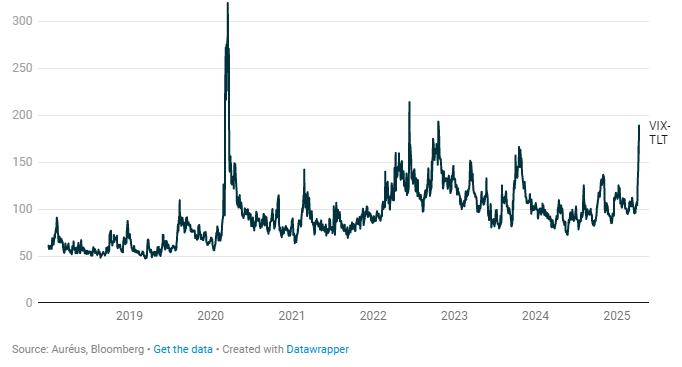

VIX on the TLT (iShares 20+ Treasury ETF)

The scale of Bessent's problem

This year, Bessent has to sell around $2 trillion in new US government debt, refinance around $8 trillion (!) in maturing bonds, and pay another $500 billion in interest on outstanding debt. All this in an environment where foreign investors are becoming increasingly reluctant to hold US government bonds. Every 100-basis-point increase in interest rates means an additional $100 billion in interest payments for the US Treasury. These annual interest payments are already higher than defence spending. Confidence in the bond market is crucial to the US government.

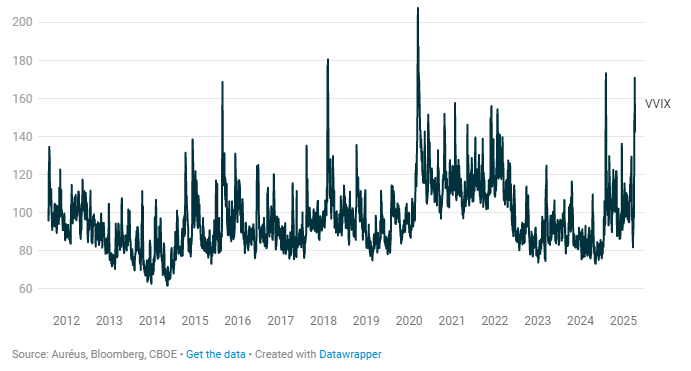

Volatility of the VIX index

The VVIX measures the expected volatility of the VIX index over the next 30 days. The VVIX is calculated based on the option prices of the VIX. The VVIX, therefore, provides insight into how stable or unstable market expectations are regarding future volatility.

The unravelling Basis Trade

The current crisis is being exacerbated by the so-called ‘basis trade’ unravelling – a financial strategy that exploits minor price differences between cash bonds and futures contracts. At first glance, this doesn't seem like a risky strategy, but with sufficient leverage, everything becomes risky. The recent volatility in the bond market has triggered margin calls, resulting in the forced sale of government bonds. If this situation is not brought under control, liquidity problems in US government bonds could spread to the rest of the fixed-income market as market makers withdraw. The leverage in these trades is now much higher than it was during the previous crisis in 2020. At that time, the Federal Reserve had to intervene to prevent the bond market from collapsing.

De-dollarisation

The behaviour of interest rates and the dollar is fuelling the theory of de-dollarisation. This theory would result in the collapse of the current monetary, political and geopolitical order, which is based on the dollar. It could cause a Minsky moment, but at the level of US government debt. This creates a fundamental tension between debtors who are too indebted, such as the United States, and creditors like China and Japan, who already hold too much of this debt and are dependent on selling their goods to the debtors to support their economies.

Trump's tariff pause

The Trump administration claims to prioritise ‘Main Street’ over ‘Wall Street,’ but in a highly financialised economy like the US, the two are closely linked. Persistent market problems would threaten the pension security of most Americans, as 54% of US households have market-based pension plans.

The Federal Reserve, meanwhile, faces a difficult choice. Despite the inflation risk, it will likely be forced to act if the bond market problems persist. The Fed may be hesitant to cut interest rates at this level of inflation, but a liquidity crisis in the bond market would likely prompt intervention. Nevertheless, analysts do not expect an interim interest rate cut unless the stock market collapses again. Based on market dynamics in 2020, specialists estimate that the Fed will intervene to support the market if the 10-year interest rate reaches 4.75%.

Short-term solutions

Bessent and his colleagues in the administration have a few options for restoring market confidence. For example, the budget deficit could be reduced. In theory, this could strengthen confidence in the ‘risk-free’ status of US government bonds, but in practice, this seems virtually impossible with rising government spending and planned tax cuts. He could also raise money by selling federal land and mineral rights, but this is a more long-term solution. Furthermore, privatising Fannie Mae and Freddie Mac is on the agenda. The proceeds could be used to pay off debts, and if these institutions lose their government guarantees, the Fed would probably accelerate its shift from mortgage bonds to government bonds.

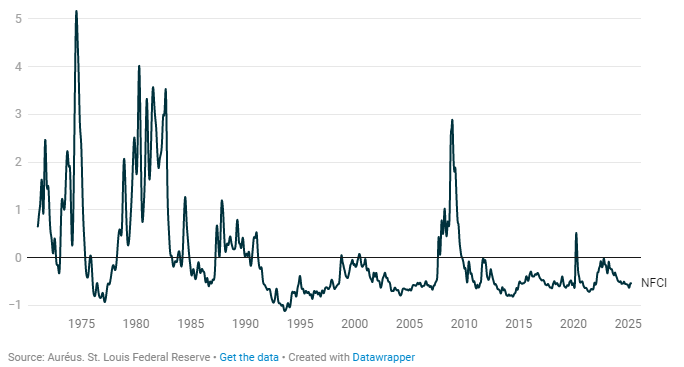

Chicago Fed National Financial Conditions Index

Despite the turmoil surrounding import tariffs, there is still no unrest in the financial system.

A faster adjustment is possible because the Supplementary Leverage Ratio (SLR) is calculated differently for commercial banks. This rule requires the largest U.S. banks to hold capital of at least 5% of their total assets. By exempting Treasuries, banks could increase their holdings of government bonds by as much as $1 trillion. Changing the SLR rule is the simplest and most effective way to restore short-term stability. This should also be positive for banks' profits and share prices, given that US banks currently pay only between 0.4% and 1.3% on deposits, while 10-year government bonds yield 4.45%.

The dollar as a reserve currency

Rising yields and a falling dollar, therefore, raise questions about the ‘excessive privilege’ of the US and the position of the dollar as a reserve currency. The basic trade unravelling may be technical in nature, but it signals a real threat to the economy and risky assets. It represents a tightening of financial conditions and banks' lending standards – factors that would undermine economic activity. Both the Fed and the Trump administration face difficult choices. The outcome will determine the future of the US bond market and, with it, the global economy as a whole.