Peter Borggren

You are welcome to contact me for a personal conversation

About Currency Sigma

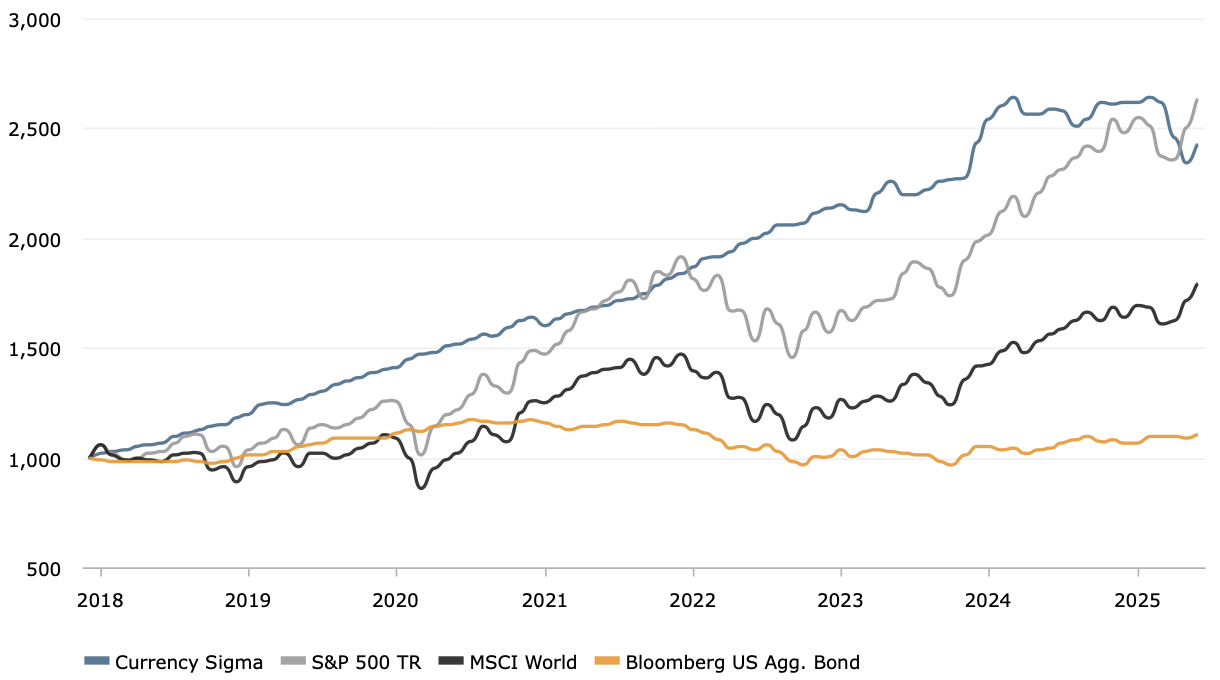

Our Currency Sigma trading strategy has consistently produced positive results every year and 83 % of the months have had positive returns. On average we have earned 13 % per year after fees. This means that our clients have achieved very good financial success with us, which over time gives them more freedom to live a good life and do what they enjoy.

Sigma has not only delivered high returns, but has been particularly stable during downturns. The worst month has been only -6,10 % and the longest recovery period after a downturn only 3 months.

Our trading is carried out with the ambition that your investment will be safe and secure, regardless of how the market performs. We use sound and systematic risk management to provide you with stable returns and keep risks low.

june 2025

Risk information

Past performance is neither a guarantee nor an indication of future results or profits. Your investments may increase or decrease in value and it is never certain that you will recover all or part of your invested capital.

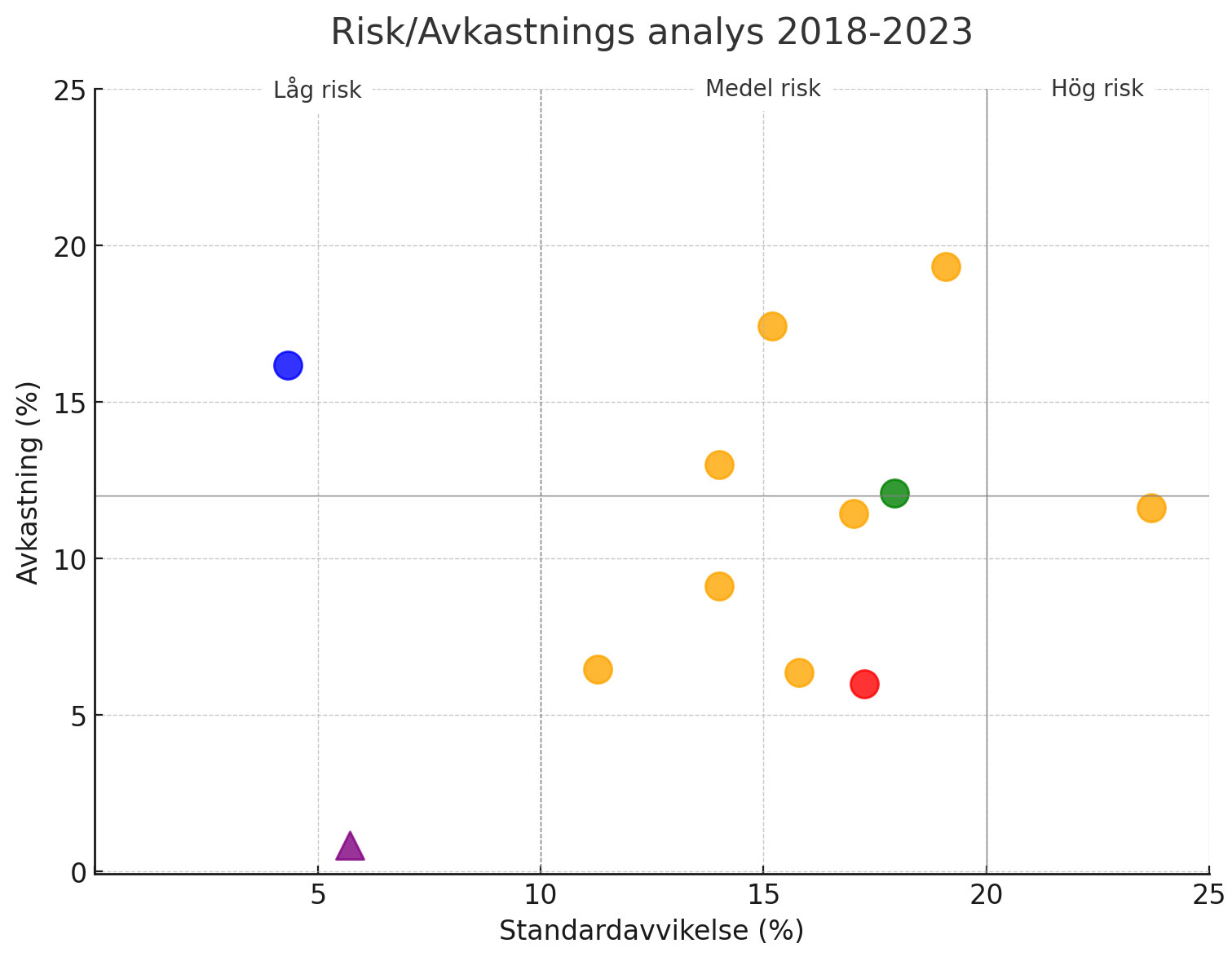

In the chart we see Currency Sigma

In the chart we see the Currency Sigma in blue in the top left. This is alongside bond indices, global equity indices and some equity funds that are known to perform well over time. We can see that Sigma has offered higher returns than the global stock market indices, while managing to keep a lower level of risk than bonds. What makes Sigma unique and sets it apart is the combination of these two.

Standard deviation

Standard deviation of Currency Sigma: 5,96

Standard deviation is a measure of a fund's risk and reflects volatility, that is, the fluctuations in returns. The higher the standard deviation, the higher the risk.

A low standard deviation means that the value of the fund has fluctuated less. For equity funds, a standard deviation below ten can be said to represent relatively low risk, while a standard deviation above twenty represents relatively high risk.

Sharpe ratio

Sharpe ratio for Currency Sigma: 2,02

The Sharpe ratio is a measure used to assess the risk-adjusted return. It shows the relationship between the return you get and the risk you take when investing. As an investor, you can use the Sharpe ratio to get an idea of how well your investments are performing in relation to the risk you are taking.

The higher the Sharpe ratio, the better. A Sharpe ratio of zero or lower is not good. For long-term savings, a Sharpe ratio above 0.5 is good, while a Sharpe ratio of 1 or higher is very good.

The Sharpe ratio is a great metric for comparing investments to each other, as it takes into account fee, return and risk - all in a single figure. If you're only going to look at one number when evaluating an investment, it's the Sharpe ratio you should use.

Our expertise

Our expertise is in currency trading and we trade the ten most common currencies, known as the G10. The most traded spot currency pairs are major and minor crosses which include AUD, CAD, EUR, GBP, JPY, NZD and USD. In addition to these pairs, spot gold (XAUUSD) is also traded regularly. Cryptocurrencies are not traded.

Interest on interest is a powerful economic principle in long-term savings and investments.

Instead of withdrawing the returns generated, you reinvest them so that your capital can grow organically over time. By doing this, the total amount of your savings increases, which in turn generates even more returns next time. Over time, the annual returns accumulate and start generating returns themselves, resulting in an exponential growth curve for your capital.