One week of import tariffs

2025-02-12

BY CHELTON WEALTH

One week of import tariffs

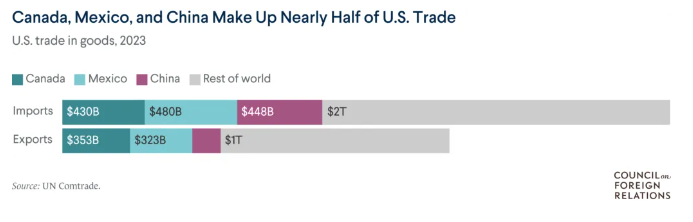

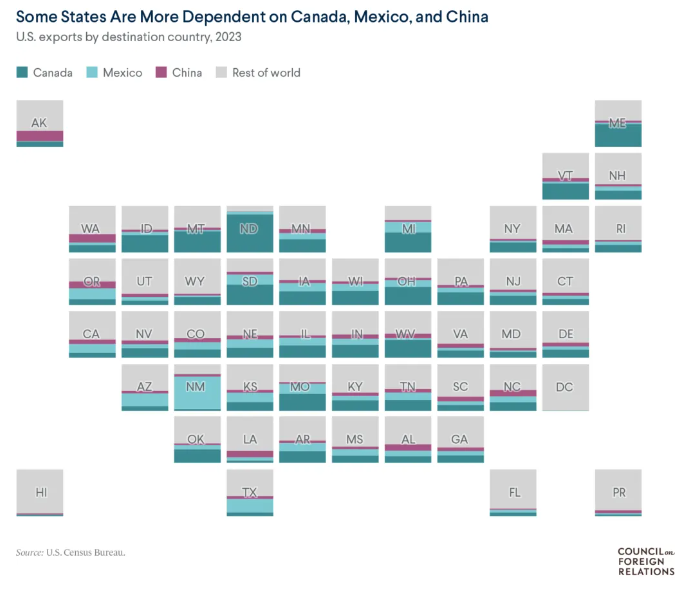

Last week, Donald Trump announced tariffs that took the markets by surprise. After his election victory, Trump indicated that he was considering this measure. Yet, it was expected to mainly be a political means of putting pressure on Mexico and Canada. After all, the aim was for both countries to control their borders better. It was also intended to prevent the influx of fentanyl into the US. Few people expected the US's closest allies to be the first target. Ultimately, a provisional deal was made with Canada, as with Mexico, resulting in a one-month delay. Since the start of the year, the stock markets of Mexico, China and Europe have outperformed the S&P 500 (in dollars). In the case of Canada, there is more to it than that.

Postponement for Mexico and Canada

No less than one-fifth of Canada's GDP consists of exports to the US. It is possible that Trump would like to use Canada as an example for the rest of the world due to Canada's weak starting position. Furthermore, Trudeau and Trump are not friends on a personal level. The fact that Trudeau has focused Canadian policy on climate change and international issues has now led to a greater dependence on the United States. According to Trump, the solution is simple. Turn Canada into the 51st state of the United States. This would create a new kind of Canadian nationalism. Just what the country needs. After all, due to Trudeau's policies, the country is struggling with economic stagnation, high debt, rising inflation, and political division.

Canadian solution for import tariffs

Trump's re-election last year spelt the end of Trudeau. Trudeau's inability to respond quickly to the threat of Trump's tariffs may have had something to do with a political vacuum in Ottawa, where his party was increasingly divided. This led to a lack of decisiveness in responding to Trump's demands. This is even though Trump's rhetoric (especially about border control and fentanyl) could quickly be resolved by having more people from the Royal Canadian Mounted Police (RCMP) guard the border.

Mexico did meet the US halfway by sending an additional 10,000 Mexican soldiers to the border. A large number of RCMP officers in their distinctive red jackets would be enough for Trump to claim a victory in the media. After all, the main reason for the tariffs is Trump's election promise to secure the American border. In the end, 1.3 billion for extra border security and the appointment of a fentanyl czar proved sufficient for Canada.

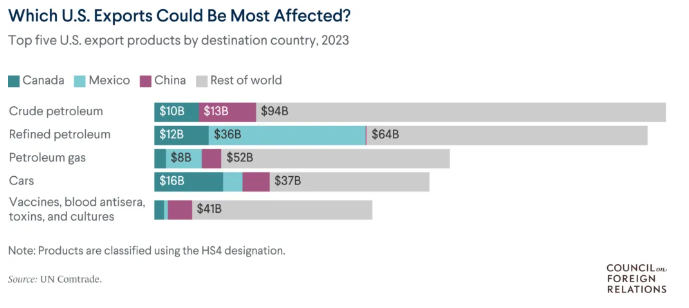

There are three possible explanations for Trudeau's failure: first, he could not respond adequately due to the internal political crisis in Canada. Trudeau thought that Canada would suffer less from the tariffs than the US. He may also have let it happen because a trade conflict is politically advantageous for the Liberal Party. The potential consequences of a trade war with Canada are significant. Disruptions in supply chains and uncertainty for entrepreneurs on both sides of the border are imminent. This will likely slow economic growth (potentially even causing a recession). That will lower expectations for investment returns. Furthermore, two-thirds of the oil for the United States comes from Canada.

Europe is the next candidate

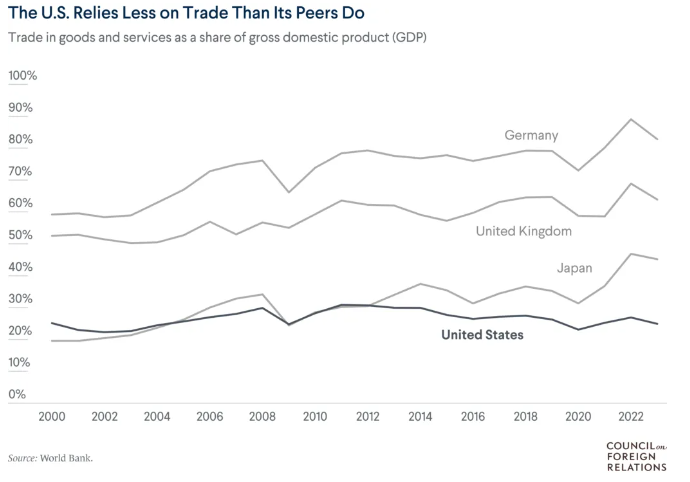

So far, Europe has managed to avoid the recent American import tariffs, but it seems only a matter of time before the world's largest trading bloc comes under fire from President Donald Trump. An American tariff measure will initially have an inflationary impact on the eurozone. Due to the flexible exchange rates, the euro would fall in value against the US dollar, increasing the cost of imported products in the EU. The EU could also respond with its tariffs on American imports, raising prices. Given the significant role of the export sector in Europe and the importance of the American market for European goods, it is likely that the negative demand shock will dominate the macro-economic picture.

European solutions for import tariffs

However, there are limits to the immediate counter-reaction of higher import tariffs. The problem is the complicated cross-border supply chains. Moreover, there is a more fundamental reason in Europe why tariffs could have expansionary effects, namely if EU policymakers decide to stimulate domestic demand for substitute products to alleviate Trump's anger over the EU's large trade deficit with the US. There were indications of such a reaction in Europe after the EU leaders' meeting on Monday. Although they said they would strike back against the US trade war, they also promised to ease the US security burden in Europe by increasing EU defence spending. EU President António Costa has asked the European Commission to create more room within the budgetary framework for additional defence spending. This reinforces the changes that are becoming visible in the EU's fiscal rules and suggests that the EU's fiscal policy is shifting from rigid austerity to a more pragmatic approach.

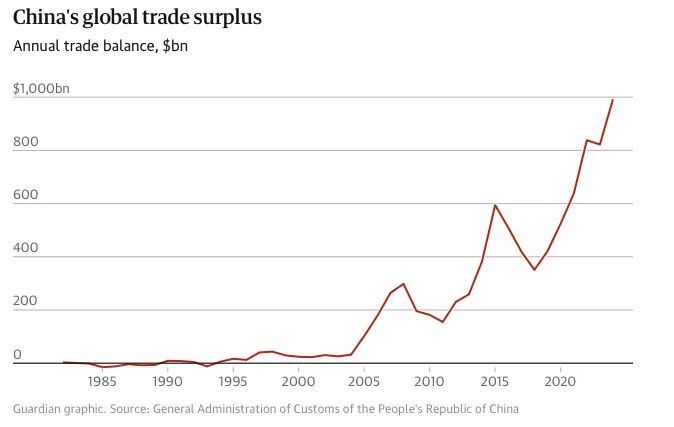

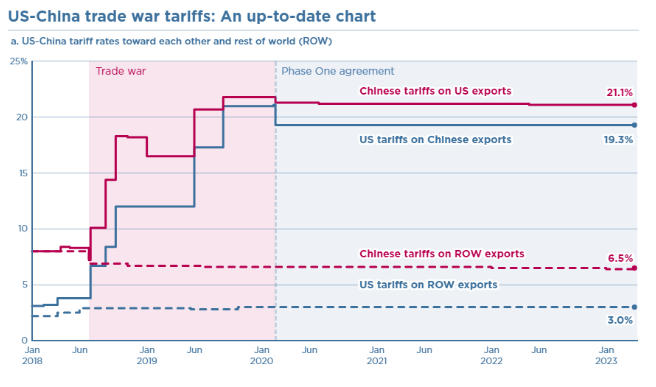

A 10% tax on Chinese products

Of the announced import tariffs, only those on Chinese imports have been introduced and are still active. This measure was postponed only when it became apparent that the tariffs on parcels from Alipay, Shein and Temu were causing a problem (because this affected no less than 30% of all US). The following four tariffs apply to other products from China. The first three tariffs from 2018 totalled 25 per cent on 250 billion worth of goods. Then, there was a 15 per cent tariff from 2019 on 120 billion worth of goods, which was reduced to 7.5 per cent in 2020. The import tariff for many products now amounts to approximately 25 per cent. China's response to these tariffs was relatively mild and aimed to start negotiations.