The dominance of the dollar

2024-04-22

BY CHELTON WEALTH

The dominance of the dollar

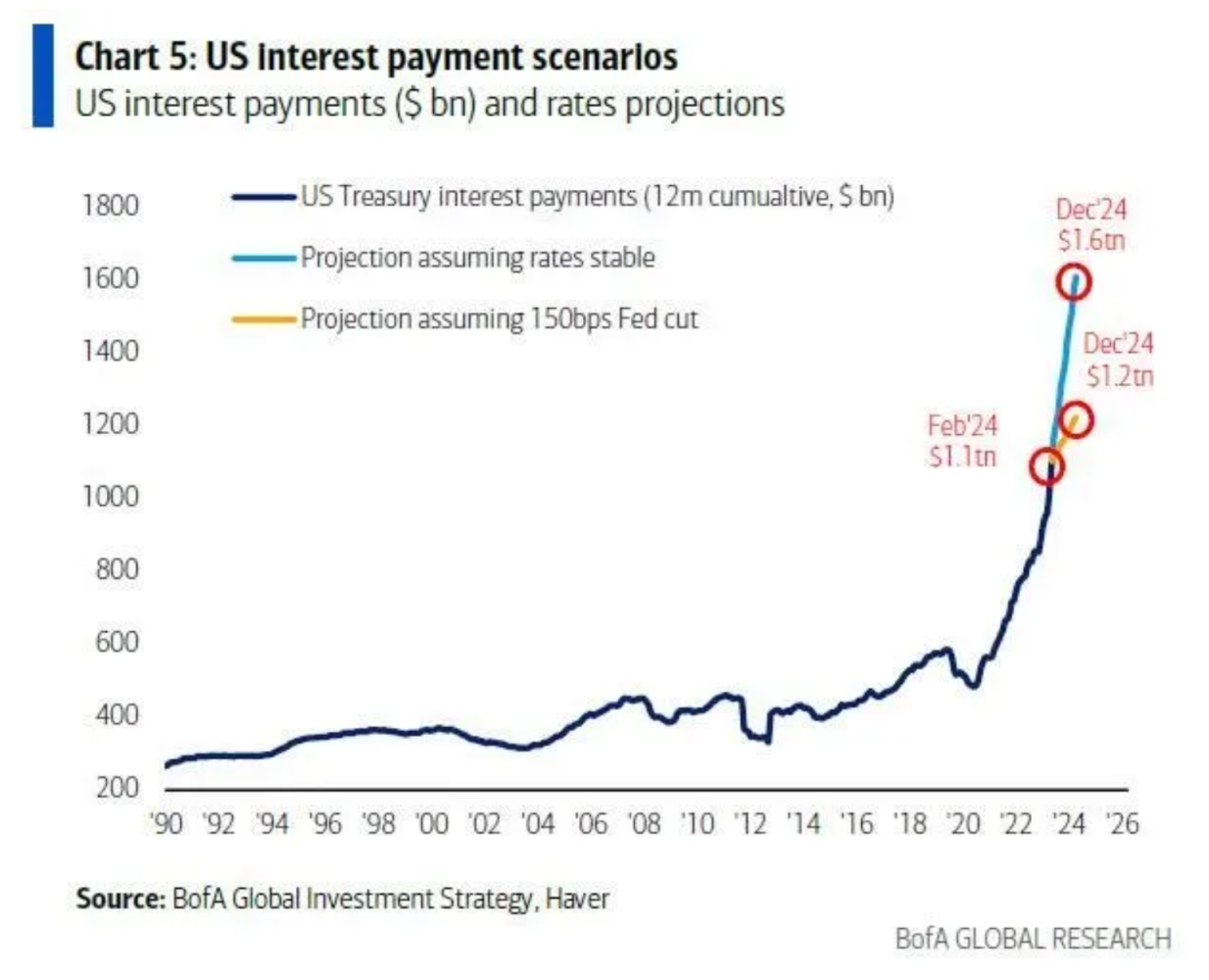

The US currency is the world’s de facto reserve currency. The US government seems to be doing all it can to undermine that. A budget deficit combined with a current account deficit argues for a weak rather than a strong currency. At the same time, thanks to those deficits, the US central bank acts as the de facto central bank of the world. Not surprisingly, Federal Reserve decisions are felt far beyond its borders. Moreover, because the dollar is the world’s reserve currency, it has the characteristic of being strong when the US economy is doing well but also when the world is doing poorly, for whatever reason. Only in between come the dollar’s weak fundamentals. It is also graphically referred to as the dollar’s ’smile’.

Dollar hedging

A stronger dollar in bad times is precisely why European investors in foreign equities should not hedge the dollar. If they do, they suffer losses on their investments and the dollar in a crisis, which is a loss accelerator. Moreover, the cost of hedging is primarily determined by interest rate differentials. For this, bondholders are still compensated, but shareholders are not. As US equities soon weigh 70 per cent in the world index, the impact of such a choice is enormous.

Dollar forecasting

Dollar exposure thus adds value at the portfolio level. Moreover, a reserve currency is naturally also a strong currency. The dollar constantly tends to be overpriced, at least relative to fundamentals. Given the major impact of dollar movements on the portfolio, everyone wants to know what the dollar will do. Unfortunately, that is not so easy to predict. As many as ten factors influence currency movements, the market tends to focus on just a few. For instance, 2001 was a typical year that the dollar was bound to weaken. Still, ultimately, the peg to the renminbi and China’s accession to the World Trade Organisation ensured a strong dollar.

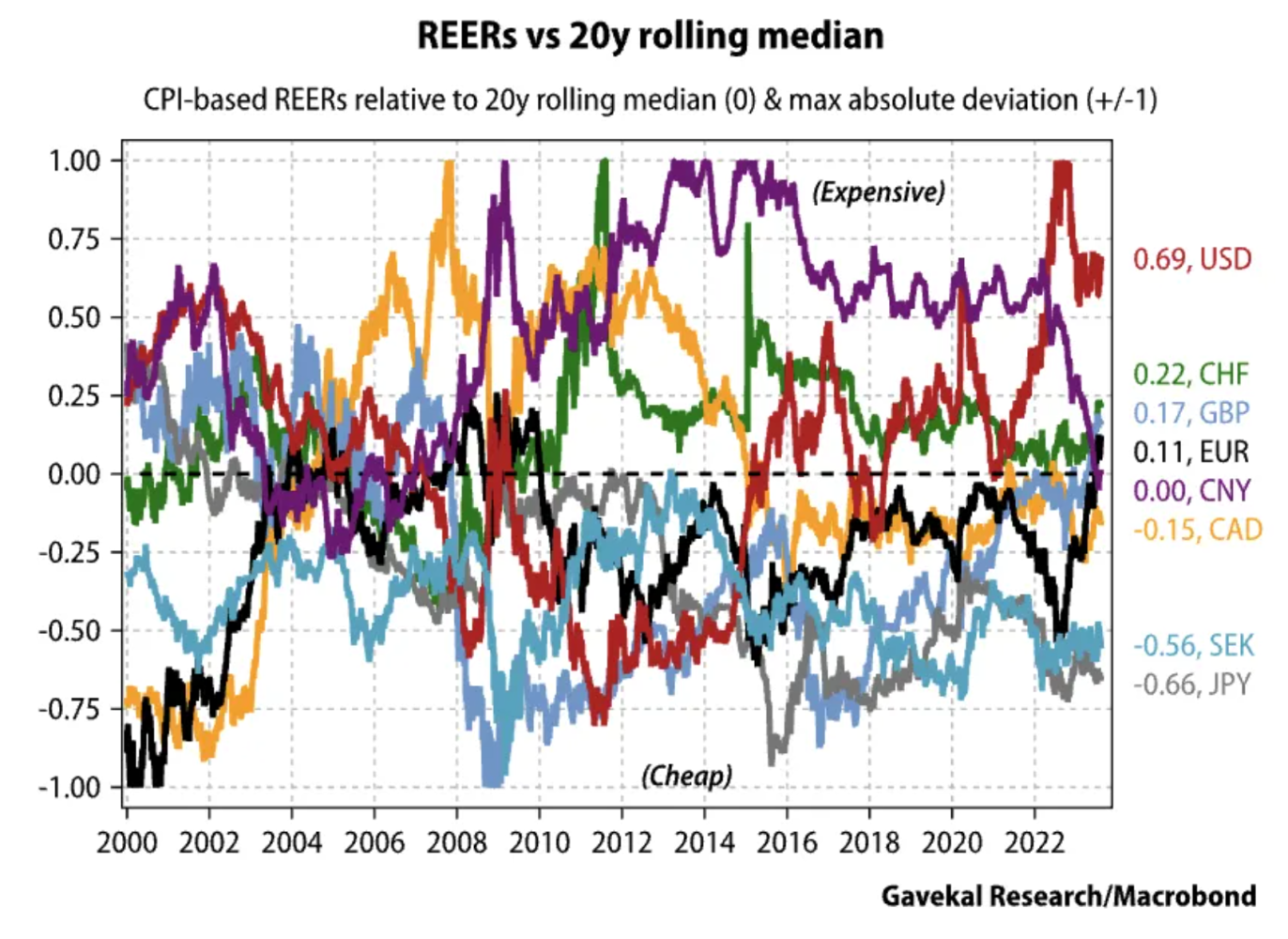

A strong economy has a strong currency

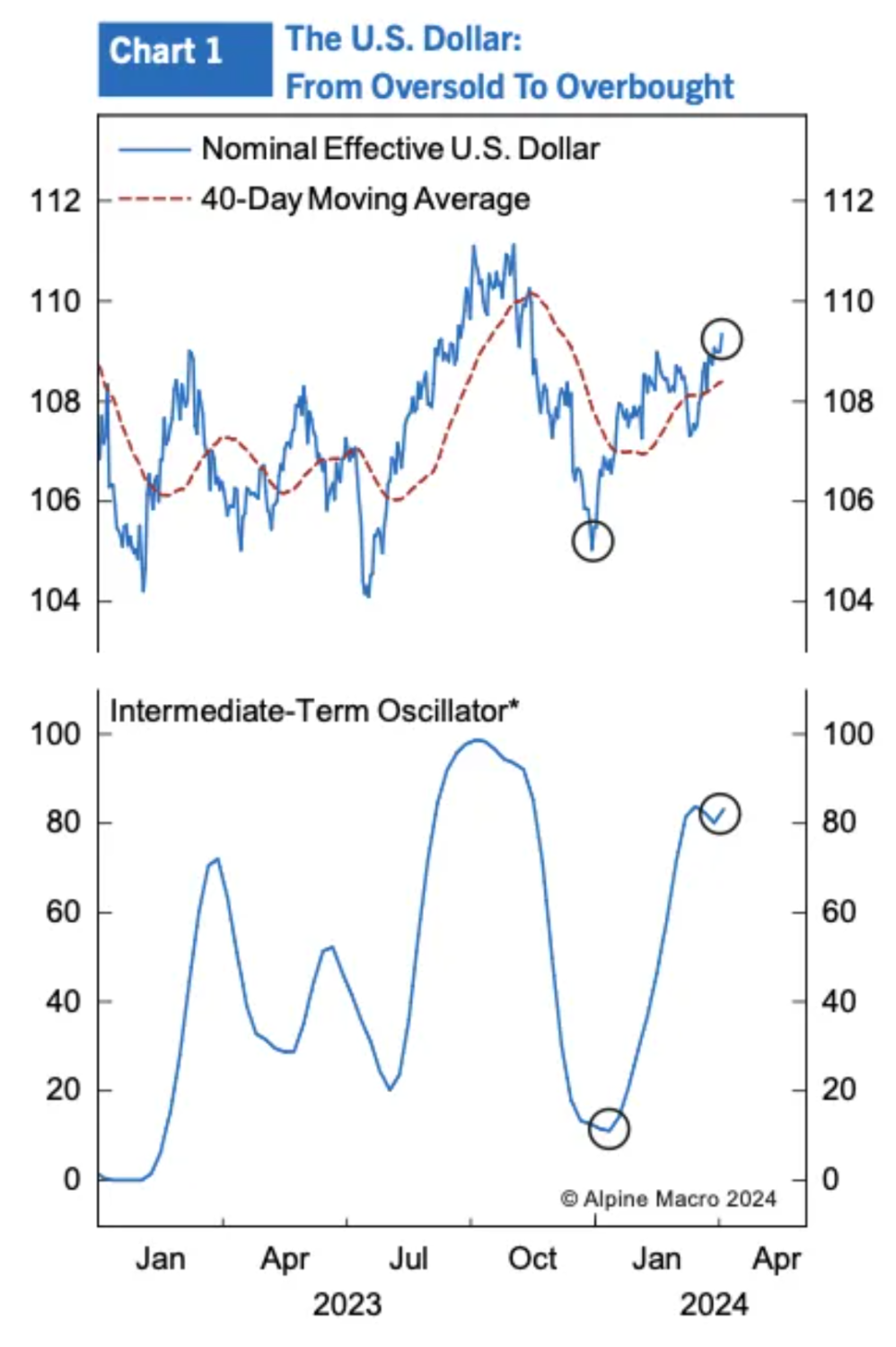

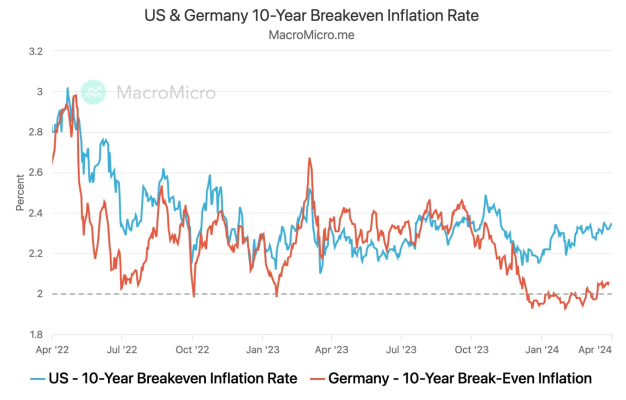

Even now, the dollar has arrived at the upper end of the valuation range, helped by the fact that the US economy is leading the charge globally. Growth recovery in Europe and Asia could also cause a turnaround because, for instance, the Japanese yen is extremely weak from a historical perspective. On the other hand, the dollar could benefit from the fact that interest rate cuts in the US are increasingly less priced. The market was still sitting on seven rate cuts this year at the end of last year, and now there are two, with question marks over whether rates will be cut at all this year. At the same time, the ECB may cut interest rates four times this year. The European stock market also outperformed the US stock market in March for the first time in a long time, possibly because Americans do not like the combination of higher-rated US stocks and extreme political polarisation.

Growth differentials determine the direction

The Chinese economy is more important than the European economy for the dollar. On a purchasing power parity basis, the Chinese economy is the largest in the world. Moreover, commodities are often traded in dollars, and China is a major consumer in that area. In addition, the eurozone is also heavily dependent on developments in China through trade. With several regions outside the US experiencing improving growth, the question of when the dollar will weaken soon arises. This often includes the rapidly rising US government debt and the fact that the dollar has been used as a weapon against the Russians. The Chinese renminbi also aspires to reserve currency status, which is still far off. As such, China needs to create a current account deficit (it currently runs a sizeable surplus). The renminbi is more of a long-term alternative to the dollar, and a lot of water still needs to pass through the Yangtzekiang.