Waiting for the first interest rate cut

2023-11-04

BY CHELTON WEALTH

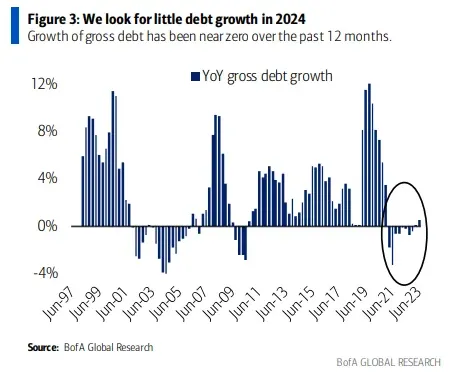

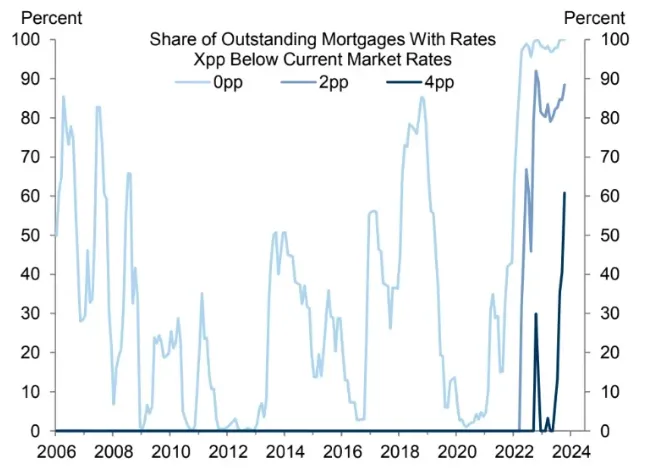

Central banks in Europe and the United States are probably ready in terms of raising interest rates. Over the past 18 months, policy rates have been raised at a rapid pace, but the full effect of those rate hikes normally follows with a 12- to 18-month lag. This time, it is taking even a little longer because interest rates have been so low for so long. Both companies and individuals (curiously not the US government) have financed themselves on historically low-interest rates for a relatively long time. While mortgage rates in the US are now above 8 per cent, a large proportion of Americans have been financed on interest rates below 3 per cent.

At the same time, many wages did rise based on underlying inflation. Not surprisingly, citizens had more to spend. Although central banks have probably stopped raising interest rates, quantitative tightening continues. Since early 2022, the Fed’s balance sheet has shrunk by about 10 per cent, from trillion to .1 trillion. The ECB is also shrinking its balance sheet but at a more moderate pace.

CAUSE SOFT LANDING

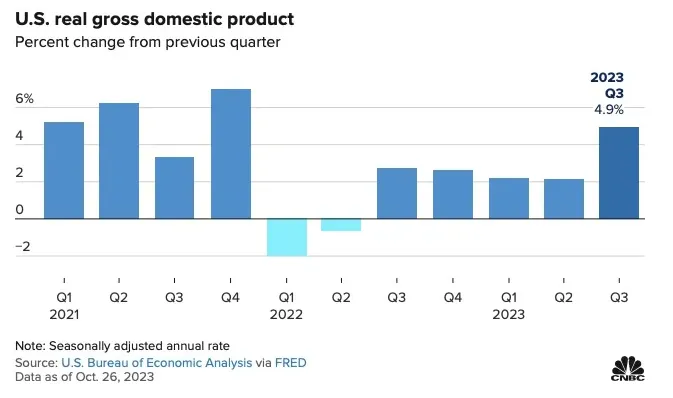

The soft landing was mainly caused by stimulative fiscalpolicy in the United States. Tax cuts and investment programmes such as the Inflation Reduction Act, the Infrastructure and Jobs Act and the CHIPS and Science Act provided a substantial boost. In Europe, this fiscal stimulus went mainly to Italy, while Germany in particular could use some help. In Europe, inflation is higher, but it can hardly be suppressed by the ECB’s higher interest rates. European inflation is mainly a result of political choices. All the ECB is doing by raising interest rates is further wrecking the economy, making stagflation a real scenario for the eurozone. In such a scenario, it is almost inevitable that there will be another euro crisis. Europe is rated low, but not without reason.

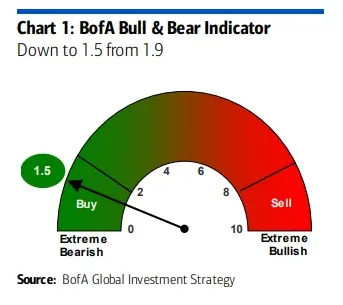

TURNAROUND SENTIMENT

Compared to mid-July, the mood in the stock market has totally reversed. Whereas the soft landing was still celebrated in the summer, the focus is now mainly on rising interest rates. Those interest rates initially rose because a soft landing was priced in. After all, that does not include a recession, which is why the inverse curve flattened. Furthermore, the Fed probably wants to prevent the market from getting too far ahead of future rate cuts. Powell came up with the longer-high scenario on 20 September, an asymmetric monetary policy where inflation windfalls do not cause lower interest rates, but growth windfalls do cause potentially higher interest rates. Based on the gloomy mood and the relatively benign time of year, it may be time to get a bit more enthusiastic about equities. Still, there are some issues that have not been fully factored into share prices.

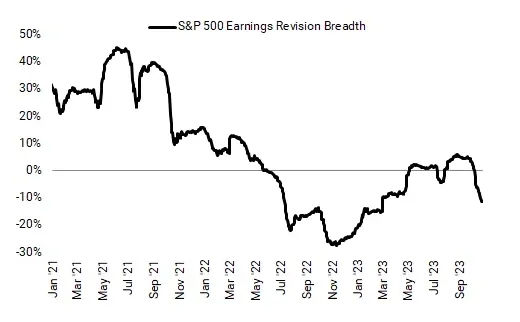

For instance, earnings estimates for the coming quarters and next year look a bit firm. Still, corporate earnings do not really disappoint and both good and bad numbers are being punished in the current market. There may not be a recession, but there is a slowdown in growth. Consumer and producer confidence shows this. For now, no monetary and fiscal stimulus can be expected, so it seems to be waiting for interest rates to fall. This could be due to the arrival of a recession or a major financial crash.

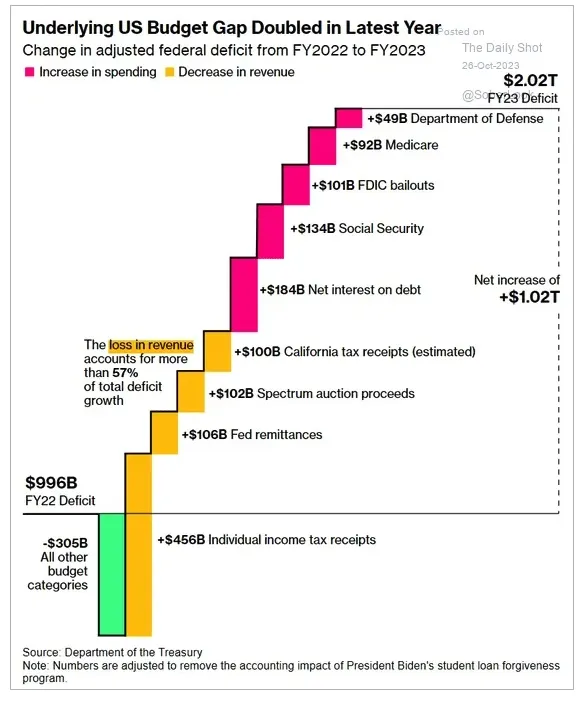

FUNDABILITY OF US SOVEREIGN DEBT

Concerns about US sovereign debt (following the rise in interest rates) are heavily exaggerated. There will never be a default on US sovereign debt, simply because the country can always print dollars to repay the debt. The right question is much more about what the dollar will be worth. Given the strength of the dollar, investors do not worry that much about US debt, it is more for the media. That attention to US sovereign debt will peak again in three weeks’ time when a new agreement on the debt ceiling is due.

There is now a new Speaker of the House, Mike Johnson from the Trump camp. Trump has been doing good business in recent weeks, both within the Republican party and ahead of the election, also helped by the terrorist attacks in Israel.

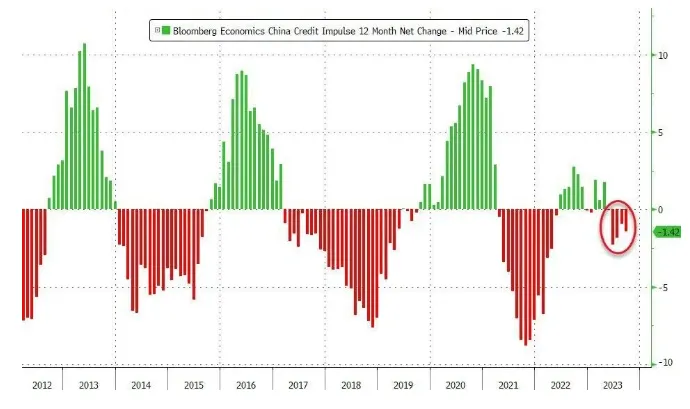

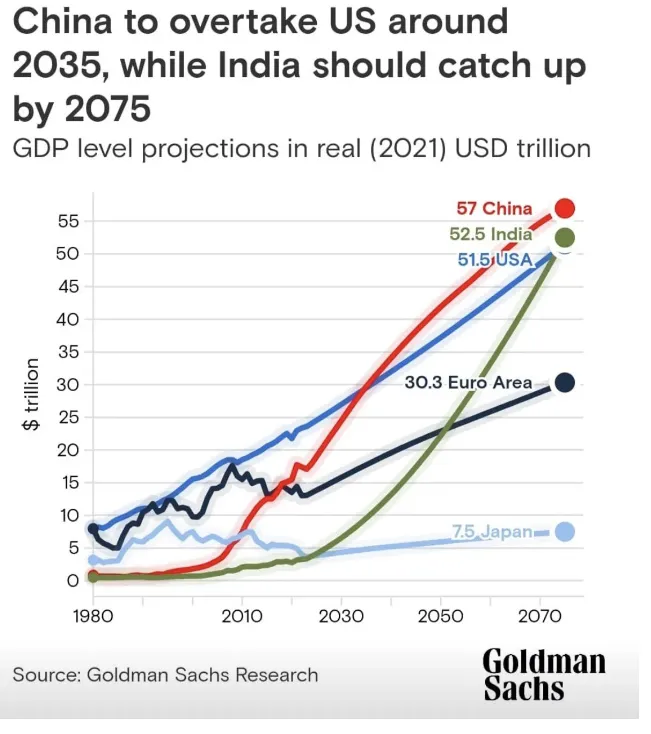

CHINESE DEBTS

There are also those worried about Chinese debt. In itself, this is strange because China, along with Switzerland, Norway, Sweden and South Africa, among others, is one of the few countries in the world with no net public debt, helped by China’s many state-owned enterprises. The problem in China is that the economy needs to be stimulated given its flirtation with deflation and high youth unemployment. The consumer demand slump is understandable as 80 per cent of all savings are tied up in China’s struggling housing market. Still, the Chinese government is reluctant to open the credit tap to avoid Japanese scenarios, although ironically, this actually threatens a Japanese scenario.

Things are not bad in China economically. Third-quarter economic growth of 4.9 per cent was in line with the US economy’s third-quarter growth (much better than expected in both cases), but in the US that was helped by the Barbenheimer phenomenon, rising inventories and government investment. The Chinese are mostly gaining market share, for instance in electric cars and other energy transition products. Given the recent 25 per cent wage increases following the UAW strikes, China may gain even more market share. I was recently allowed to take a ride in a Chinese Nio (with an auto-interchangeable battery) and it showed again that many electric cars are interchangeable throughout due to the wind tunnel effect, and that there is a relatively steep learning curve, especially for Chinese electric cars. A Chinese car in the lower sentiment then quickly wins out on price.

Waiting for positive momentumAlthough the long-term return outlook is improving rather than deteriorating due to recent developments in financial markets, we will still have to wait for more positive impulses, for instance in the form of lower interest rates. Liquidity is a factor that is often underestimated but still has a major impact on financial markets. An interest rate cut could be due to a recession next year, a done deal for the eurozone, but not yet for the US. Or due to a financial crash. The combination of the previous (US) banking crisis (whose cause in the form of higher interest rates has not yet been removed) and the tightened Basel rules is putting additional pressure on the economy. Only investors in private markets (private debt) will wonder, with current high yields, why they would buy equities at all. The global euro equity market is now some 8 per cent below its mid-September 2023 peak and also 8 per cent below its November 2021 peak. If there is a bear market, this is more one in time (for more than 2 years now) than one in price, although that is a different story for many mid- and small-caps.