Japanese interest rates to rise further

2025-01-30

BY CHELTON WEALTH

Japanese interest rates to rise further

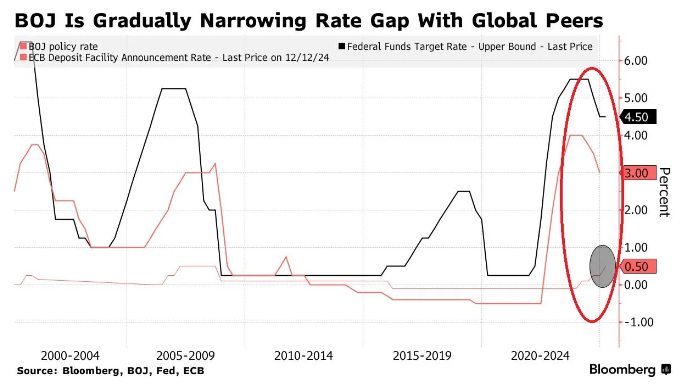

The Bank of Japan (BoJ) raised the policy rate by a quarter to half a per cent, the highest level in 17 years. The central bank said economic activity and wage and price inflation will reach targets to justify its commitment to ‘normalise’ monetary policy. The BoJ’s 8-to-1 decision raised the policy rate to its highest level since the 2008 global financial crisis. Speculation was rife about whether Governor Kazuo Ueda would wait for more substantial evidence of rising Japanese wages and sustainable inflation, but suddenly, Ueda was confident.

Tricky communication

Since taking office in 2023, Kazuo Ueda has struggled to communicate effectively with financial markets. Unexpectedly, interest rates were raised in July last year. This led to a discussion on numerous carry trades from Japan and caused a global correction of around 10 per cent in equity markets in August. Then, it looked like Ueda would raise interest rates again in December, but at the last minute, the BoJ pivoted. Then, he wanted to see more evidence that wages would rise, adding to the uncertainty about US policy. Those uncertainties have now disappeared. Wages in Japan are indeed increasing across a broader front. By the end of March (the end of the fiscal year in Japan), Ueda further reckons inflation will be 2.7 per cent. That was 2.5 per cent until recently. For the coming year (to March 2026), the BoJ is sitting at 2.4 per cent (was 1.9 per cent).

Carry trade at risk

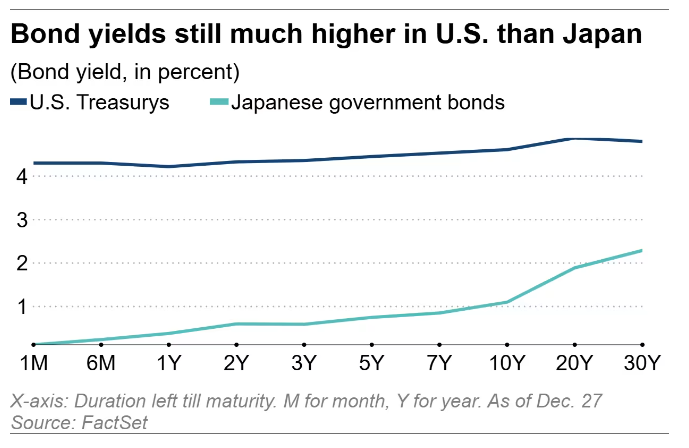

Despite the interest rate hike six months ago in Japan, new carry trades are still being set up from Japan. The size of the carry trade, combined with its complexity, makes it difficult to gauge its extent. Yet the demand for loans in the Japanese yen suggests that it has not yet ended. In recent decades, the yen carry trade has been a lucrative strategy for investors with deep pockets. Essentially, it amounts to borrowing yen, a low-interest rate currency, and then investing it in assets and/or currencies that offer higher returns. The interest rate hike in the summer of 2024 first led to a limited unwinding of the carry trade and a strengthening of the yen, from which the gold price seemed to benefit.

Size of the carry trade

The Bank for International Settlements (‘BIS’) produces a quarterly report, and the latest concludes that rather than being discouraged by the events of July 2024, many indicators point to a rebound in the carry trade in yen. For example, yen-denominated claims on non-banks outside Japan reached $880 billion in the first quarter of 2024, a significant increase from the fourth quarter of 2021. Also, in derivatives markets, yen-denominated instruments grew to a massive $14.2 trillion by the end of 2023, representing a 27% increase in yen-denominated instruments since the end of 2021. As the BIS notes, the exact size remains uncertain due to the complexity and opacity of global financial markets.

Insufficient incentive to unwind carry trade

The carry trade is effectively a short yen trade. The yen has fallen again against the dollar since July. This causes higher costs due to rising prices for imported goods and contributes to higher inflation. Food prices in Japan are growing at the strongest pace in eight months (4.8 per cent). Lee Bok-hyun, the governor of the Financial Supervisory Service, said on 24 January that despite the BoJ’s interest rate hike on Friday, the incentive to unwind yen carry trades is low as the interest rate differential between the US and Japan widens and the yen remains weak.