Japan's weak yen

2024-07-19

BY CHELTON WEALTH

Japan's weak yen

There are as many as ten factors that affect the strength of a currency, and the extent to which each factor affects the currency can often only be determined in retrospect. Forecasting currencies is not easy. Only in the long run is it easier because, ultimately, the currency follows the development of the economy. A strong, flexible economy with high economic growth also has a strong currency. In the short term, money flows, interest rate differentials and debt positions play a greater or lesser role. In addition, there is always the question of what sentiment is already priced in. The opposite often happens if everyone has a positive or negative view of a currency.

Japanese yen

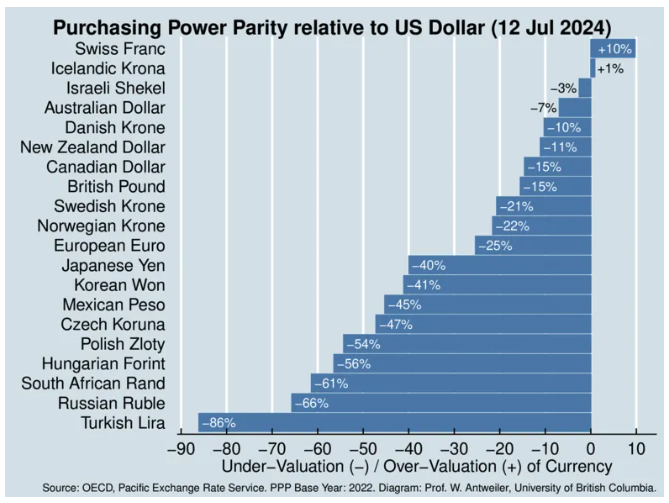

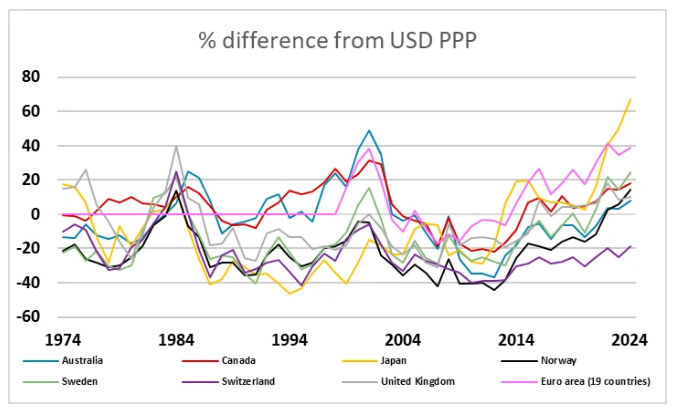

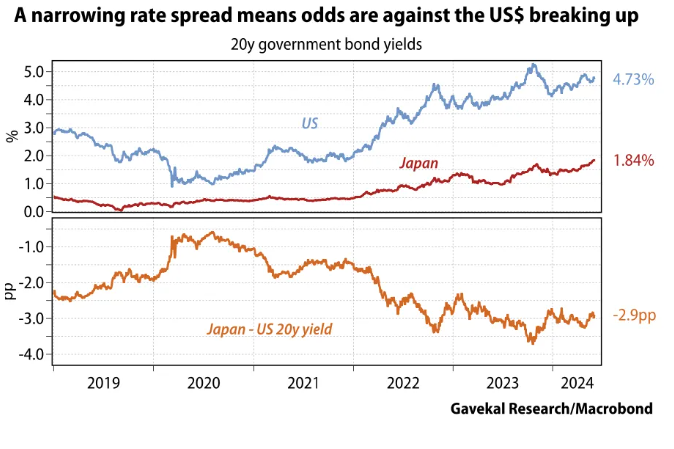

The Japanese currency is some 40 per cent undervalued against the dollar on a purchasing power parity basis. Conversely, it can be argued that the US dollar is about 70 per cent overvalued. That means everything in Japan has become extremely cheap, many travellers to Japan will confirm. The undervaluation has been caused primarily by Japan's loose monetary policy. As long as many countries outside Japan were also playing the monetary craze, this was not such a problem. Still, many interest rate hikes further explain interest rate differentials, a large part of the yen's current undervaluation. With the Federal Reserve about to cut interest rates for the first time in September and Japan more likely to have arguments to raise interest rates, the narrowing interest rate differential may ensure a strengthening yen.

Japan as a safe haven

Japanese are wealthy and hold a significant proportion of their assets outside Japan. Typically, they do not hedge the currency in the process. With a structurally falling yen, Japanese investors, therefore, benefit twice. Only at the moment of global turmoil do many Japanese investors repatriate their funds. As a result, the yen gains strength. As a result, Japan is often mentioned as a safe (currency) haven for investors outside Japan. Due to Japan's low interest rates, it remains attractive for the Japanese to invest in foreign investments; this year has also resulted in double-digit returns. But in 2021 and 2022, rising interest rates outside Japan did cause losses. In that case, the yen had to be sold to cover dollar losses, further weakening the yen. Now, people will want to avoid further losses.

Japan as an export country

A weaker yen automatically translates into higher Japanese corporate profits. However, production has been moved to other parts of Asia, making Japanese businesses less dependent on the yen. Despite this, the correlation between Japanese corporate profits and the yen development remains high. In recent years, China has become a much more important exporting country at the expense of the United States. That means the yen must be able to compete with the equally cheap renminbi. Japan is doing that well at the moment, especially at the expense of the Germans. For now, Japan is gaining market share thanks to the weak yen.

Normalisation of the US yield curve

Once the currently inverse yield curve in the US normalises to a steep one, it will no longer be interesting to continue holding this carry trade (short yen, long dollar) because of losses on long-term dollar bonds. At that point, many Japanese institutions and companies will repatriate their currency positions outside Japan, allowing the yen to recover relatively quickly. That moment will likely coincide with the start of the first rate cut by the US bank, preferably combined with a simultaneous rate hike by the Bank of Japan. As a result, the dollar may weaken somewhat against several currencies, but the yen, in particular, may appreciate sharply.