Jackson Hole Economisch Symposium

2024-08-16

BY CHELTON WEALTH

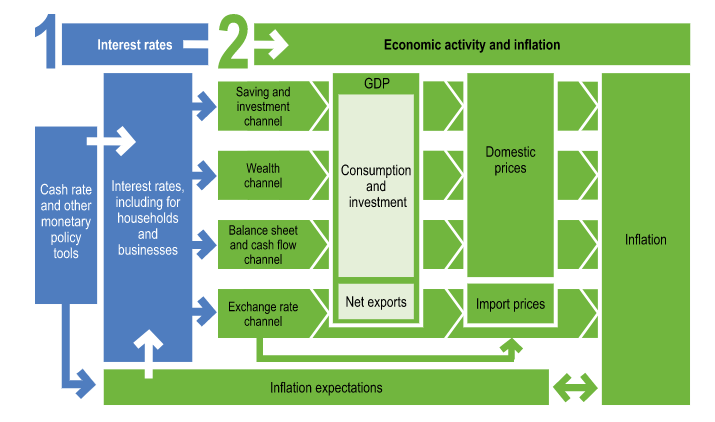

From Thursday, 22 August, the Federal Reserve Bank of Kansas City will host the Jackson Hole Economic Symposium. Attendees include central bankers, economists and specialist media from around the world. This year's theme is the effectiveness of monetary transmission mechanisms. This is how changes in the money supply affect household, business and foreign spending. There were recessions in 1991, 2000, 2008 and 2020 as shocks hit the economy. In 1991, there was a commercial property crisis. The shock in 2000 was the bursting of the dot-com bubble. In 2007 and 2008, house prices fell, the banking sector got into trouble, lending contracted, and the Great Financial Crisis occurred. In 2020, the shock consisted of the coronavirus pandemic.

Changing monetary policy

This time, there is no such shock (yet). The shock now consists only of the Fed raising interest rates. The Federal Reserve wants to understand the effect of interest rate hikes better and avoid a hard landing. With some regularity, the symposium in Jackson Hole also sets the stage for monetary policy changes. Powell will likely announce the first interest rate cut for September in Jackson Hole. Otherwise, the discussion will focus on how many interest rate cuts are needed this time. For now, the first interest rate cut in September will be followed by two more this year and the FOMC, the Fed's policy-making body, will continue with this every meeting until the summer of 2025.

Monetary transmission mechanism

Monetary transmission is often through the housing market. This time, homeowners in the United States are stuck in their homes because they have overdrawn mortgages at historically low interest rates. They are ‘locked in’. In the United States, the interest rate on a mortgage is typically fixed for 30 years because when interest rates fall, such a mortgage can be transferred to a new mortgage with a lower 30-year interest rate without too much cost. Due to the sharp rise in interest rates, people are stuck on the old low rates, which frustrates the transmission mechanism. The same also applies to many companies that have fixed interest rates at extremely low levels. Those do not notice anything about higher interest rates for the time being. Some companies cannot pay much higher market interest rates just like that because their cash flow is lower than the normalised interest charges on debt. These are the so-called zombie companies. As a result, the effects of monetary policy become increasingly digital. First, the economy does not feel the higher interest rates for a long time, but at some point, it can then quickly escalate.

Self-reflection

Jackson Hole is also typically a time for self-reflection. Central bankers were regularly on the wrong track in recent years, or so it seemed. First, inflation was supposed to be temporary, only to raise interest rates sharply. Meanwhile, much of that inflation appears temporary, but central bankers keep interest rates high for longer. Central bankers no longer dare to look into the future and are ‘data dependent’. As a result, they mainly look at ‘lagging indicators’ such as inflation and unemployment.

Negative effects of monetary policy

In practice, current monetary policy is doing more harm than good. The flattening of the economic cycle has prevented excesses from being properly eliminated and 'zombie' companies from getting in the way of innovation. Monetary policy has contributed to a huge mountain of debt. Then, it doesn't help that monetary policy often creates confusion. According to the central bank, commercial banks take irresponsible risks because interest rates will stay ‘low for longer’. The real economy is being hit by interest rates that stay ‘higher for longer'. Due to rising unemployment (albeit from an extremely low level and caused by increased labour supply) and stock market volatility, the Fed is becoming more aware of the dual mandate (full employment in addition to price stability). As a result, the Fed will start cutting interest rates in September.

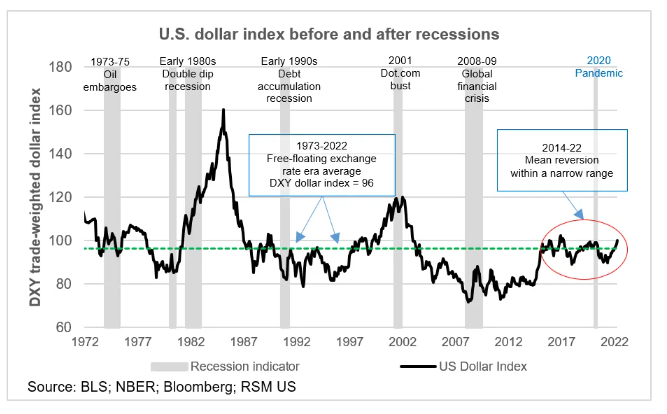

Central bank of the world

The Federal Reserve is not only the central bank of the United States. Since the dollar is the main reserve currency, the Fed is also the world's central bank. Since the Great Financial Crisis, the US government's fiscal policy has also frustrated Federal Reserve policy. Where previously monetary and fiscal policy moved more in tandem, there is now regular conflicting policy. In recent years, the Fed tried to put the brakes on the economy, while politicians, through investment and rising fiscal deficits, actually provided additional stimulus. One of the consequences was an excessively strong US dollar. This jeopardises the independence of central banks.

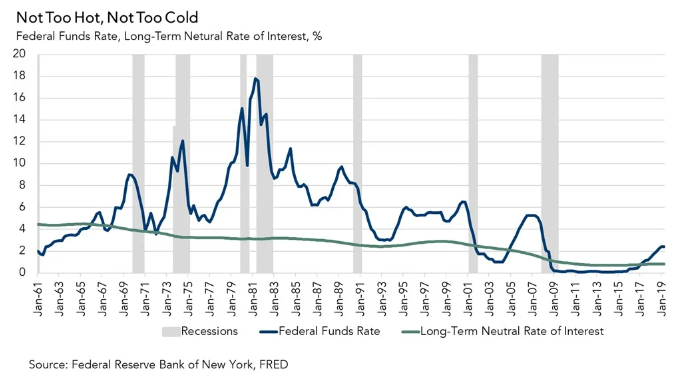

Simple alternative

The alternative to current central bank policies is simple. Instead of excessively low interest rates creating bubbles, zombie companies and eventually the new normal with lots of debt but no economic growth, interest rates should go up. Those interest rates should not be so high that healthy companies can no longer finance themselves, causing monetary policy to cause a recession. Interest rates should be just above the equilibrium or natural rate. Indeed, it only makes sense for faster-growing companies to finance themselves at that level. Financing makes no sense for companies growing in line with the economy (equal to the natural interest rate). This encourages innovation, productivity and, hence, economic growth. The key issue for Jackson Hole's agenda is the level at which the natural interest rate is now.