Impact lower policy rates

2024-09-27

BY CHELTON WEALTH

Impact lower policy rates

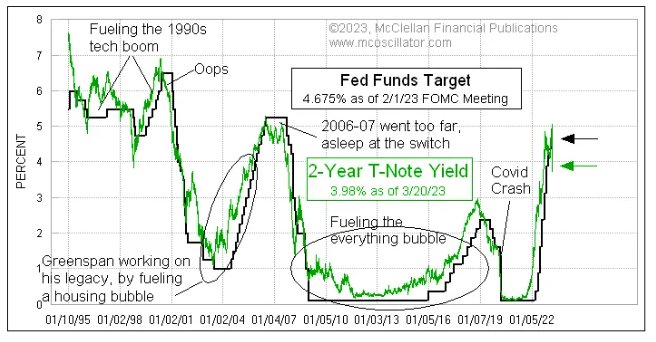

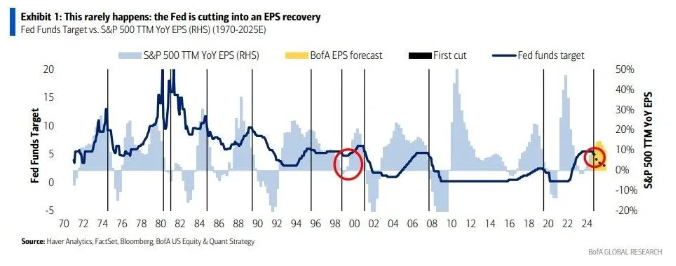

It took a while, but last week, the Federal Reserve cut interest rates for the first time since 2020. The policy rate immediately went down by half a per cent. According to Powell, to emphasise that he wants to stay ahead of the curve, but he is only just succeeding because inflation has now started to fall rapidly. In addition, Powell wants to emphasise with the 50 basis points that he is more confident of meeting the inflation target of 2 per cent.

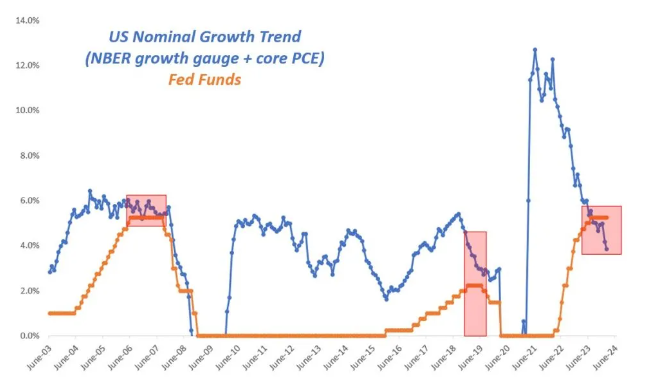

So please don’t panic, although the Fed implicitly admits it waited too long. It is notable, however, that the Fed cut interest rates by 50 basis points while inflation is still above 2 per cent. The Fed’s other objective (full employment) has become more important. In the background, a factor will be that the United States also has a debt problem that can be solved through reflation (short- and long-term interest rates structurally lower than the economy's nominal growth rate). An inflation rate higher than 2 per cent will help with this.

Growing economy despite interest rate hikes

Despite the sharp rise in interest rates over a short period, the US economy continues to grow. Last quarter, it was 3.0 per cent; for this quarter, the Atlanta Fed indicator assumes 2.9 per cent. The neutral interest rate is higher rather than lower than the current rate. Otherwise, it would hit the economy harder. Now, the Fed also admits that it takes longer for the effect of previous rate hikes to show up, but some effects should be visible now. At the same time, US consumers i richer than ever, industrial production is growing, the government is spending more and investment is still on the rise. That picture is different outside the United States, though. In China, there is a softening caused entirely by Beijing itself. Germany and France are not doing well; thus, the European Union is not doing well. The US economy is relatively closed, but it is not helping.

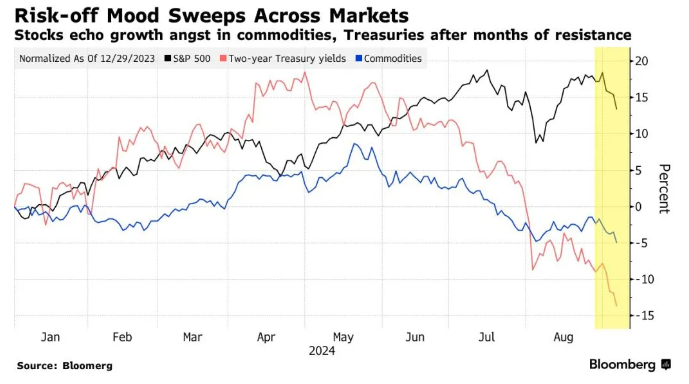

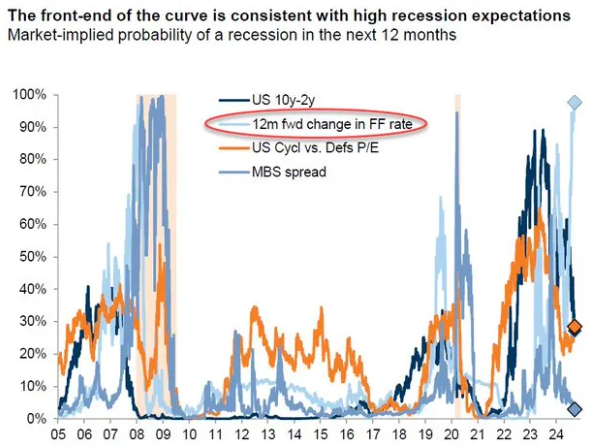

Recession, according to the bond market

Yet, interest rates have fallen so much in the US bond market that a recession should be imminent. This starkly contrasts the stock market, which still trades at record levels. This, coupled with the 50 basis point interest rate cut, is remarkable because the likelihood of such a recession diminishes (and all upcoming interest rate cuts). Besides the stimulative effect of lower interest rates, the US government will likely stimulate the economy after the election through lower taxes (Trump) or government spending (Harris). If that recession does not happen, long-term interest rates will have to increase.

Structurally higher growth rate = structurally higher real interest rate

Interest rates must also go up because, in the long run, the growth rate of the US economy is higher than it was from the period after the Great Financial Crisis until the coronagraph. This is due to various investments in artificial intelligence and increased immigration. In addition, the 2 per cent inflation target is likely to be a floor (not a ceiling) due to several more structural factors combined with looser monetary policy (although the Fed is unlikely to admit that).

The current neutral level is too low

According to FOMC data, 2.9 per cent is the neutral level for the policy rate; only that rate is too low to fit the structurally higher real growth rate of the US economy and higher long-term inflation expectations. That would take us back to the days of the ‘new normal’, and that is unlikely. While there is much variation among the different members of the FOMC (from 2.4 per cent to 3.8 per cent), the consensus in the FOMC is too low, and that means that long-term interest rates need to go up to the pre-Great Financial Crisis range (3.5 to 5.5 per cent).