The US dollar

2025-02-28

BY CHELTON WEALTH

The Us dollar

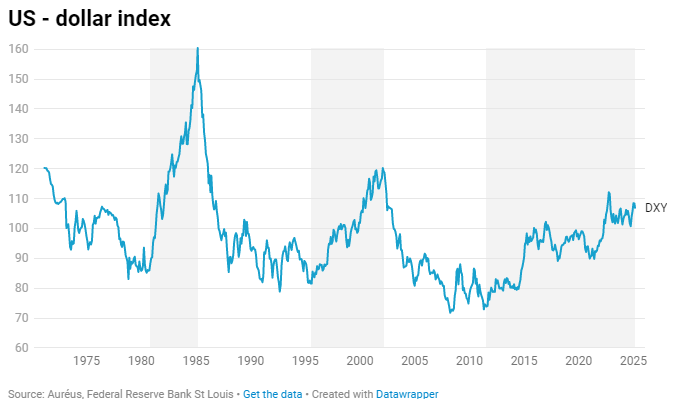

Since the decoupling of the US dollar on 15 August 1971, there have been three major bull markets in gold. The first started in the early eighties when Paul Volcker was willing to risk a double-dip recession to get inflation under control in the US. That ended with the Plaza agreement (a hotel bought by Trump in 1988 but ended in bankruptcy). The second began with the start of the dot-com bubble in mid-1995 and ended in January 2002, at the end of the interwar period that started after the fall of the Berlin Wall. The last bull market in the US dollar began at the nadir of the Great Financial Crisis, and its end is regularly predicted.

Reserve currency of the world

The American dollar is the world's reserve currency, making the Federal Reserve the de facto central bank of the world. But the Americans are playing with fire. A reserve currency is characterised by the fact that everyone accepts it. The Americans are now also using the dollar as a weapon. First, it was against countries like Sudan and Iran, but more recently, it was against the Russians. The result is that the Russians can no longer access their dollar assets. This means that the United States runs the risk that other countries with a somewhat volatile relationship with the US will also become less interested in dollars. The Chinese have already halved their extensive dollar positions, and the Arabs are also accepting other currencies (renminbi) for their oil.

Declining dollar reserves

The worldwide peak in dollar reserves reached in the early seventies at 85 per cent. In the years that followed, this dropped to 50 per cent. At the start of the new millennium, this recovered to 72 per cent, after which the decline resumed, reaching 57 per cent today. Only during the euro crisis was there a temporary recovery. The dollar's main rival until the euro crisis was the euro. However, the euro crisis has taught us that the European monetary union is not yet complete and extremely unstable. The euro's peak in currency reserves reached 28 per cent in 2010 but has since stabilised at 20 per cent. The euro (or all G10 currencies) has also been used as a weapon against the Russians (no less than 50 per cent of the Russians' frozen reserves are in euros). The renminbi accounts for only a few per cent, partly because it is not freely tradable.

In recent years, currency reserves have mainly been moving to countries where the British royal family is portrayed on the banknote: the United Kingdom, Canada and Australia. In addition, the Japanese yen and the Swiss franc are now also popular. Although there is much to criticise about the dollar, it has no clear rival. However, the problem for the Trump administration is that a strong dollar stimulates imports and hinders exports. Furthermore, fiscal stimuli may cause more inflation and, thus, a stricter monetary policy and a stronger dollar.

What the dollar needs to weaken is a flexible American monetary policy in combination with a strict fiscal policy. Furthermore, the performance of the Chinese economy is also crucial for the dollar's direction. The weak Chinese economy of the past years has caused a stronger dollar, but with the upcoming Chinese People's Congress in March, it is questionable whether this will remain the case. Those who use the Chinese stock market as a leading indicator will quickly conclude that the Chinese economy is also growing.

Restructuring American debt: Mar-a-Lago agreement

Drastically restructuring American debt is part of Trump's team's agenda to reform world trade by using tariffs, weakening the dollar and lowering borrowing costs. This put American industry on a more equal footing with the rest of the world. This resembles the weakening of the dollar after the Plaza Accord in 1985. The concept is now called the Mar-a-Lago Accord, after the American president's new summer palace, also known as the Southern White House. The idea of a Mar-a-lago agreement was elaborated in a paper written in November 2024 by Stephen Mirran, who will head up the White House economic advisors.

However, a Legal agreement is not that simple. The dollar has risen since Trump's re-election, and international cooperation is not one of Trump's strongest points. What Trump is good at is applying pressure. One component of the Mirran plan is converting their Treasuries positions into long-term (100-year) zero-coupon bonds. Such a move could succeed under the pressure of sufficient import tariffs. Therefore, the chance of a Legal agreement may increase in the coming quarters.